|

Franks Happy Place posted:The short answer is that unless you are making six figures you probably want a TFSA. And no, TFSAs are not just for short-term poo poo, in fact they are best stuffed full of long-term growth stocks (like eSeries funds!) Beautiful, thanks.

|

|

|

|

|

| # ? Apr 23, 2024 16:47 |

|

Does anyone else have a health spending account through their benefits? Ours is a Visa card that we can spend however we want, but the limit is $500 per year for individuals and $750 for families and we don't have any other programs to cover health specialists like physio or chiro or anything. Just wondering if this a crappy plan or not. Our revenue per headcount is around $160k.

peter banana fucked around with this message at 17:12 on Oct 16, 2014 |

|

|

|

the last signal... posted:I've got an appointment set up today to open up a mutual fund account at a TD so I can try to get this coveted eSeries account. When I made the appointment the lady asked me if I wanted to open a RRSP or TFSA account and I wasn't sure. So for a TFSA, your contribution money was included in your income on which you paid tax for that year. For an RRSP, your contribution is deducted from your taxable income from that year. When you withdraw money from your RRSP, that withdrawal is counted as taxable income on that year's return. So if you have a high income when you're young and pay lots of taxes you want to fund your RRSP before you fund your TFSA based on the assumption that your income will be lower when you plan to draw from your RRSP. This provides tax relief through deferral. If your income is low now and now when you retire you'll want to fund your TFSA first as you wont benefit from deferring the taxes until later and you'll want to protect gains from future tax changes.

|

|

|

tuyop posted:Thanks, I'm not sure what that does for my point which is that credit closures are very rare and dividends and compounding returns are regular so it's preferable to leverage all of your mid-long term (aka emergency) savings and bet against the very rare from happening. Yeah, I'd probably make that same bet, for sure.

|

|

|

|

|

Does anyone have advice for my ESPP question in the investing thread: http://forums.somethingawful.com/showthread.php?noseen=0&threadid=2892928&perpage=40&pagenumber=243#post436344626 ?

|

|

|

|

Went in to get a TD TFSA Mutual Funds account, my rep kept insisting that TFSA contribution room starts building the year after you turn 19, instead of the year you turn 18. Where do they hire these people?

|

|

|

|

Wilhelm posted:Went in to get a TD TFSA Mutual Funds account, my rep kept insisting that TFSA contribution room starts building the year after you turn 19, instead of the year you turn 18. Where do they hire these people? The sad thing is that it's these people that the majority of Canadians trust with their money.

|

|

|

|

Wilhelm posted:Went in to get a TD TFSA Mutual Funds account, my rep kept insisting that TFSA contribution room starts building the year after you turn 19, instead of the year you turn 18. Where do they hire these people? melon cat fucked around with this message at 22:16 on Feb 4, 2024 |

|

|

|

Wilhelm posted:Went in to get a TD TFSA Mutual Funds account, my rep kept insisting that TFSA contribution room starts building the year after you turn 19, instead of the year you turn 18. Where do they hire these people? I was at CIBC today trying to transfer money from my TFSA savings account into a new short-term TFSA GIC account and the lady said she would have to deposit the money from my TFSA savings into my debit account, and then transfer it to the GIC account. I was like uhhh pretty sure you can just transfer it straight across and I don't want to lose my contribution room and she was insistent that's the way it had to be done, so I left. Went to a better branch downtown and got it sorted in 5 minutes. The person there couldn't believe what the first lady was telling me.

|

|

|

|

.

melon cat fucked around with this message at 04:26 on Mar 16, 2019 |

|

|

|

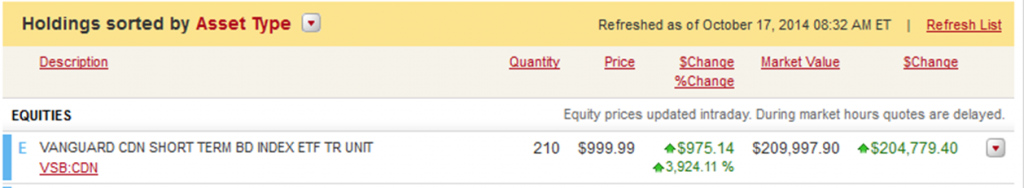

Well, some wonderful news in my online brokerage account this morning. Seeing as I bought at about $25/share, I feel this was a solid investment. (I do notice the odd glitch on the site, but this one takes the cake)

|

|

|

|

Aagar posted:Well, some wonderful news in my online brokerage account this morning. Haha that's hilarious.

|

|

|

|

Haha - what brokerage is that?

|

|

|

|

Lexicon posted:Haha - what brokerage is that? CIBC. Their new slogan: "CIBC: You'll think you're richer than you are." It's back to normal now. Too bad - could have had the house paid off.

|

|

|

|

Aagar posted:Well, some wonderful news in my online brokerage account this morning. Congrats

|

|

|

Aagar posted:Well, some wonderful news in my online brokerage account this morning. I think that's the kind of jump that's safe to time.

|

|

|

|

|

Another e-series question: how are dividends handled with the four recommended index funds? Is it quarterly, yearly, no divendends at all? I'm just wondering what sort of returns to expect as I start contributing to these funds.

|

|

|

|

TDB900 (Canadian stocks) and TDB902 (US stocks) have distributions in December. TDB909 (Canadian bonds) has distributions monthly. TDB911 (international stocks) has distributions in March, June, September, and December. You can verify this yourself by clicking here and read the "fund facts" document for the fund you're interested in. It's near the top right of the first page.

|

|

|

|

So if you were planning on selling shares in a fund, you would be best to sell as soon after a given dividend distribution date as you can, right? I mean, if you were planning on going and taking that money and investing it in other things that also disburse dividends. Along the same lines, if you buy TDB911 on February 28th, would your dividend be the same amount as someone who bought the same amount of shares in January? I would assume not...

|

|

|

|

Rick Rickshaw posted:Along the same lines, if you buy TDB911 on February 28th, would your dividend be the same amount as someone who bought the same amount of shares in January? I would assume not... Distributions go to whoever holds the fund on a specific date. The fund company doesn't care how long you've held it, so if the fund distributes on March 1, then yeah, both people would get the same amount.

|

|

|

|

acetcx posted:TDB900 (Canadian stocks) and TDB902 (US stocks) have distributions in December. I really appreciate your help. Thanks very much!

|

|

|

|

Rick Rickshaw posted:So if you were planning on selling shares in a fund, you would be best to sell as soon after a given dividend distribution date as you can, right? I mean, if you were planning on going and taking that money and investing it in other things that also disburse dividends. Stock price generally dips by an amount equal to a dividend payment. Unless you had it in an unregistered account and really wanted to save a buck by paying taxes on capital gains instead of dividends, it would be a wash.

|

|

|

|

Yeah, the fund price will drop by exactly the amount of the distribution on the distribution date. So if the fund is worth $20/unit and there's a $0.10/unit distribution then the new fund price will be $19.90/unit (plus or minus any of the usual daily movement in the price). There's no way to game distribution dates. Note that this is why looking at price graphs can be misleading if they don't include distributions (i.e. there will be a drop on the distribution date even if the index didn't drop). The same thing is true of dividends and if you think about it it makes sense. If a company is worth a billion dollars and it pays out 10 million dollars worth of dividends then the company must now be worth 990 million dollars. The share price must drop by an equivalent amount. If you think about it even more this means that aside from tax considerations there's no real advantage whether the growth in a stock comes from capital gains or dividends. A stock's growth is (capital gains + dividends) so whether it's mostly capital gains or mostly dividends or something in between doesn't really matter (other than taxes). This is why I think it's a bit silly when people glorify dividend stocks - what you care about is total growth. A dividend stock that has 2% growth and a 3% dividend in a year is worse than a growth stock that has 6% growth in a year. You want the stock with the most growth and if you want a regular income stream then you can just sell some of your shares in the growth stock on a regular basis.

|

|

|

|

acetcx posted:If you think about it even more this means that aside from tax considerations there's no real advantage whether the growth in a stock comes from capital gains or dividends. A stock's growth is (capital gains + dividends) so whether it's mostly capital gains or mostly dividends or something in between doesn't really matter (other than taxes). This is why I think it's a bit silly when people glorify dividend stocks - what you care about is total growth. A dividend stock that has 2% growth and a 3% dividend in a year is worse than a growth stock that has 6% growth in a year. You want the stock with the most growth and if you want a regular income stream then you can just sell some of your shares in the growth stock on a regular basis. I see your point, and I'm not disputing it, but for me it seems like we are now in a world where huge gains and losses can just happen on a whim. I feel more secure, knowing that an automatically reinvested dividend means I have additional units that will build in value on the way up from a large dip. Then again, this instinct may have absolutely no rational basis, and I further demonstrate my limited financial understanding.

|

|

|

|

Bucswabe posted:I see your point, and I'm not disputing it, but for me it seems like we are now in a world where huge gains and losses can just happen on a whim. I feel more secure, knowing that an automatically reinvested dividend means I have additional units that will build in value on the way up from a large dip. That's true of individual companies, and always has been. The market as a whole has been steadfastly up and to the right (albeit with some big bumps along the way) in line with economic growth and the march of productivity. I believe capitalism is a profitable endeavour – hence it makes sense to invest in the totality of the market.

|

|

|

|

acetcx posted:This is why I think it's a bit silly when people glorify dividend stocks - what you care about is total growth. Totally agree. Modulo tax treatment differences, it's bogus to be obsessed with dividends.

|

|

|

|

I'm looking for a bit of advice on how to proceed with funding my RRSP and TFSA for retirement. Up to this point, I've been building up my TFSA with a selection of index-tracking, lost cost ETFs (XIC, ZEA, XBB, VUN). I also participate in an ESPP, which is held in an RRSP. I've only been enrolled for 4 months, but my plan is to liquidate my available holdings every 6 months so I can diversify more broadly into index funds. I will do this by transferring the shares to my discount brokerage RRSP, and then selling the funds. The problem is... how do I build my portfolio across a TFSA and RRSP, especially taking into account tax-efficient placement? My portfolio sizes are very low, and will be built up through regular contributions, which at this point come more regularly through the ESPP/RRSP. Obviously I can't transfer funds from my RRSP to my TFSA, and since the ESPP is deducted from my gross pay, the RRSP is going to build up faster. I do put what I can into the TFSA, including all tax refunds, but it's not as regular. I know it's not optimal, but would "mirroring" my portfolio across the TFSA and RRSP make sense in my situation? Then once I have a portfolio above $60k+ I can look at moving into a more tax efficient allocation? I don't want a bunch of cash sitting on the sidelines in my RRSP, and would rather put it to work in the market. I know that an RRSP is the best place for USD-based US index funds, that certain amounts of tax withholding are irrecoverable in a TFSA/RRSP, and if you've used up your registered account room it's best to hold Canadian securities in a non-registered, etc., etc. but is that really a huge issue in the "accumulation phase"? I just want to focus on building up my investments, but should I do it at the expense of having a perfect portfolio? I'm also thinking of just dumping everything in the RRSP into something like VXC for simplicity's sake, but then that will mess up my overall asset allocation and force me to eventually buy the equivalent ETFs later down the road

|

|

|

|

Related question to the above - is there any reason to not split investments across many different ETFs instead of just four to cover the four asset classes covered in Canadian Couch Potato? That is, US Index, Canadian Index, International Index and Canadian Bonds. Or should you just pick one of each and stick with it? An example portfolio allocation I've been recommended is ZCN, XUS, XEF, VAB. Should I stick to those? Would there be any downside to also picking up the CCP recommended ETFs of VCN and VUN? I was recommended ZCN/XUS over VCN/VUN because of an even lower MER on the former.

|

|

|

|

Rick Rickshaw posted:Related question to the above - is there any reason to not split investments across many different ETFs instead of just four to cover the four asset classes covered in Canadian Couch Potato? That is, US Index, Canadian Index, International Index and Canadian Bonds. Nominally, Dividend reinvestment at lower total values; if your dividend is too low in any particular share to buy a unit, you will receive it in cash. The main reason is, if there are two ETFs that do a similar job, one will be better overall (lower MER) or better for your needs (more or less risk) and you should stick with that. Which ETFs you buy is mostly based on what are the cheapest ones you can access - if you can do eseries, ishares, and vanguard Canadian Bond etfs, there's no benefit in doing all three when two are strictly inferior.

|

|

|

|

Speaking of owning identical ETFs, question: Are there any rules and/or laws against selling one ETF to cause a capital loss then buying a near identical one to maintain your market position? If you sell one fund and buy another that tracks the exact same stocks and report the capital loss on your taxes is this asking for a visit from Revenue Canada, or is this not hosed up at all and totally cool?

|

|

|

|

ductonius posted:Speaking of owning identical ETFs, question: Are there any rules and/or laws against selling one ETF to cause a capital loss then buying a near identical one to maintain your market position? If you sell one fund and buy another that tracks the exact same stocks and report the capital loss on your taxes is this asking for a visit from Revenue Canada, or is this not hosed up at all and totally cool? This is very explicitly not permitted! It is called the Superficial Loss Rule. You have to wait 30 days before buying back in to avoid getting nailed under this. Thankfully, with index ETFs you can circumvent it somewhat by buying an ETF that's highly correlated, but tracks a different index: http://canadiancouchpotato.com/2013/10/24/finding-the-perfect-pair-for-tax-loss-selling/. For instance, sell VCN and buy ZCN.

|

|

|

|

ductonius posted:Speaking of owning identical ETFs, question: Are there any rules and/or laws against selling one ETF to cause a capital loss then buying a near identical one to maintain your market position? If you sell one fund and buy another that tracks the exact same stocks and report the capital loss on your taxes is this asking for a visit from Revenue Canada, or is this not hosed up at all and totally cool? As long as it's not the exact same one you're cool. So if you want to claim a loss on VUN and buy XIC at a bargain, go ham!

|

|

|

|

Guest2553 posted:As long as it's not the exact same one you're cool. Inaccurate as stated. You cannot sell and then buy two different ETFs that track the exact same index; for example, the S&P500, or S&P/TSX 60 – even if they are from different providers and with different symbols. If you do, the loss is deemed superficial. Guest2553 posted:So if you want to claim a loss on VUN and buy XIC at a bargain, go ham! This is true, but it's a bizarre, unhelpful example. Of course you can claim a loss on VUN and then buy XIC - entirely different assets that track different national indexes in different countries. It's also true that you can claim a loss on RY and then buy GOOG, but I don't think that's relevant to the original question.

|

|

|

|

Lexicon posted:Inaccurate as stated. You cannot sell and then buy two different ETFs that track the exact same index; for example, the S&P500, or S&P/TSX 60 – even if they are from different providers and with different symbols. If you do, the loss is deemed superficial. Well I learned something today. Thanks for the chiggity-check before the wriggity-wreck. I meant to type VCN/XIC but the premise behind it would have still been wrong.

|

|

|

|

So is the TD e-series for sure the best way to go when starting out? I'm starting from scratch and monthly contributions seems like a good plan, but I will probably aim to be into 5 figures within a year. Is it still a good idea to start out with the e-series? If I do go with e-series, would things be simplified by doing all of my banking with TD? I'm going to be switching banks soon anyway, and don't really have a preference, so I thought it might be easier. One more question: when you go into TD to set things up, do you need to open several accounts (TFSA, RRSP, non-registered) to later convert or can you do that online later? My brain hurts trying to figure all this out. I wish I could have taken more finance electives in university.

|

|

|

|

Guest2553 posted:Well I learned something today. Thanks for the chiggity-check before the wriggity-wreck.

|

|

|

|

To open e-series, you have to open a regular mutal funds account for every type of account you want. So if you want RSP, TFSA, and non-registered e-Series accounts, you have to open a regular mutal funds account for each (so three total). You then must complete this form for each of the accounts to convert them into e-series. Mail them in. You will know the conversion has gone through when the branch number for the account changes to 2378 (you can easily see these branch numbers in EasyWeb). You now have access to e-funds when purchasing mutual funds. EDIT: Also it seems YMMV depending on the person at your bank, but mine made me commit either a $25/month ongoing contribution to each account or initial $100 contribution to open each account. I have heard of people not having to contribute anything, and some who were forced to put some money down. reflex fucked around with this message at 15:33 on Oct 23, 2014 |

|

|

|

|

Electrical Fire posted:So is the TD e-series for sure the best way to go when starting out? I'm starting from scratch and monthly contributions seems like a good plan, but I will probably aim to be into 5 figures within a year. Is it still a good idea to start out with the e-series? I personally am planning on switching to Questrade and purchasing commission free ETFs. They have a lower MER than equivalent e-Series funds. I have about 20k in my RSP with TD, and once I hit 25k in January, I'll be moving to Questrade (Questrade will reimburse TD's transfer-out fee if 25k+). I have some money in Questrade already and am liking it. If you do go with e-Series, I don't think banking with TD would make things a whole lot easier. Transferring money via the Pay Bills section of my CIBC Online Banking interface has been pretty drat easy. The money shows up in my TD RSP within two business days. So I'd pick the bank that has the best sign-up bonus at the time you're planning on switching. May as well get a free iPad or $400-500 cash for your troubles. If that happens to be TD, then great - you could probably transfer money a little quicker than I can, but that'd probably be the only benefit. edit: Also, I don't understand what all this conversion/e-Series talk pre-account opening is about. All I did was go into a TD branch and asked to open a TD Waterhouse Direct Investing account containing one RSP account and one TFSA account. They did that, and then I was able to purchase e-Series funds via WebBroker. Not once did I ever discuss "e-Series" with anyone when opening my accounts. Rick Rickshaw fucked around with this message at 15:47 on Oct 23, 2014 |

|

|

|

Electrical Fire posted:So is the TD e-series for sure the best way to go when starting out? I'm starting from scratch and monthly contributions seems like a good plan, but I will probably aim to be into 5 figures within a year. Is it still a good idea to start out with the e-series? You might as well open all three accounts for simplicity. You don't need to use them. You need to do it in the branch, unfortunately. As a rule, it's stupid to have all your business with one bank – just like it's stupid to buy all your household needs at a single grocery store. Far better deals to be had by shopping around. Just because TD has a good index MF offering does not make them a good place, necessarily, for everyday banking.

|

|

|

|

|

| # ? Apr 23, 2024 16:47 |

|

Rick Rickshaw posted:edit: Also, I don't understand what all this conversion/e-Series talk pre-account opening is about. All I did was go into a TD branch and asked to open a TD Waterhouse Direct Investing account containing one RSP account and one TFSA account. They did that, and then I was able to purchase e-Series funds via WebBroker. Not once did I ever discuss "e-Series" with anyone when opening my accounts. There are two avenues to purchasing e-series: - Via a Waterhouse account: you're golden - easy to purchase. The problem is, they have annual fees for small account balances - not great for new investors. - Via a 'converted' TD Mutual Funds account - no annual fees or transaction costs, however you need to take a regular account and have it converted first. This is what everyone keeps going on about.

|

|

|