|

Food, Water, Shelter Perhaps you've noticed that last part eating up a good bit more of your income, or maybe you've replaced the water with alcohol in an attempt to not care. Either way this thread is for you! Here we can discuss everything about the US housing market: Past, Present, and (bleak, soul-crushing) Future! The US housing market and housing policy is very, very confusing. It makes more sense if you think of it less as a single unified machine and more of a constant fiery trainwreck of pretty much every single problem in America: race relations, income inequality, education, class divides, perverse incentives, consumerism, unintended consequences, rent seeking (both types!), over-regulation, under-regulation, and straight up greed. Oh and lots of bubbles. A few of the Players Real Estate agents and the National Association of Realtors- Oh I'm sorry REALTORS®. Essentially the gatekeepers and lobbying arm of the real estate industry. Extraordinarily powerful and the second largest single lobbying spender. Only cares about three things: that as many houses get sold as possible, that the prices only go up, and that a pair of realtors are there to collect 6% when the sale happens. As predictable as a used car salesman: now is always the best time to buy/sell a house as far as they are concerned. If something has any possibility of causing owning a house to be any less desirable or even theoretically decreasing prices, they are steadfastly against it. Any attempt to make the process of buying a house transparent and easy, they are against it. Any attempt to give tenants more protection, they are against it. Often engages in cartel behavior to prevent access to MLS data by sites such as Redfin, Trulia, or Zillow. The mortgage interest deduction is pretty much their deity at this point. Fannie Mae, Freddie Mac - Strange half-independent corporations (Government Sponsored Entities) which purchase mortgages from banks, take a cut, and then sell insured shares of the pool (a mortgage backed security, or MBS) to whoever wants a steady return with relatively low risk. Before the crisis the insurance was widely believed to be backed by the US Government, but this was not explicitly so. When the crisis hit they were the only firms still bundling mortgages (because that was pretty much their entire business) and essentially the entire mortgage market depended on them existing. This the very definition of too big to fail and were taken over by the Government, making that insurance guarantee explicit. The only reason these companies are still alive is because nobody can agree on how best to kill them. Democrats don't like that they are for-profit but salivate at the opportunity that they can be used to push "progressive" housing lending policy. The GOP wants them cut entirely loose with zero government backing because a right wing talking point attempts to blame the entire economic crash on government interference via these two companies. So nothing gets done. Some hedge funds bought up tons of dirt cheap stock post-government takeover and are really really pissed that the government is taking that money instead of paying out the huge profits the GSEs are making to The FHA - Originator of low-down-payment loans to first time homebuyers with a small fee added onto the monthly payment for the service. Made up a crazy-high percentage of the market post Global Financial Crisis because money for down payments evaporated for most people. Recently instituted much more expensive fees because their reserve was depleted by loans going bad which has cut demand. Why did that happen? Fraud plain and simple. Bogus charities were set up that would “donate” the meager down payment the FHA required to a prospective broke homebuyer, then after the property sold the selling developer/builder/agent would give a larger donation to the charity in sincere appreciation of their help. The NAR fought hard to get them re-legalized but eventually lost because the loans were going bad at 3x the normal rate. The Banks - Out to get as much money for themselves as possible with as little risk as possible. Have pretty much completely given up the charade of modifying mortgages at this point beyond people just refinancing to lower rates. Increasing interest rates have gutted the major profits generated for their refinancing arms and [http://www.bloomberg.com/news/2014-02-03/banks-in-u-s-ease-loan-standards-in-fed-survey-as-demand-rises.html]now rumblings about more permissive lending are starting[/url], but the banks are on the whole terrified of being forced to keep any parts of their loans on their own books. Watch out for "creative" solutions. Hedge Funds - Have decided that driving up prices of food wasn't good enough and have now been buying up residential property and securitizing the rental income, often renting to the very same groups of people that were kicked out of the house due to the financial crisis and a bank refusing to write down the loan amount. The properties are commonly foreclosures bought at prices that you just can't get unless you have hundreds of millions of dollars in cash to wave at a bank saying you want to take 70 forceclosed properties off their books, but in some regions a large chunk of low to middle teir properties are purchased by these funds. In some regions estimates are that this purchase activity wass 30%+ of the market, but is rapidly declining now. Homebuilders - A mixed bag really. Profits are up for some, but mainly due to higher house prices. In general they are holding back on aggressively building out already in the works subdivisions to keep supply low and prices high. The Boomers and other Retirees - Bet heavily as a generation on housing as a retirement fund so are all about rising prices. Much to the dismay of the younger generations which were hoping to inherit a house or at least the equity it represents the retirees are now increasingly taking out reverse mortgages, leaving the bank with the house when they die. However if they do decide to sell they are often quite annoyed with the... Millennials - Simply put are not buying houses like previous generations and the real estate industry is alternating between tut-tutting about how the drat kids will come around eventually and near panic about a massive slice of the market (starter homes) evaporating. The generation has been screwed in many ways economically: large debt loads from student loans leave little room in the budget for rent much less to save for any sort of down payment; jobs are hard to find and unreliable; parents are unable to help with down payments; and massive competition in many housing markets from hedge funds and flippers. Suggested discussion topics Rents - With many people unable to afford a house, housing inventory being low anywhere that jobs exist, and general NIMBYISM often having preventing large scale multifamily projects rental inventory is very tight and getting worse. As a result the rent is entirely too drat high, with half of all renters being cost-burdened. Government support of homeownership - For homeowners: the mortgage interest deduction, Federal backing of most mortgages, abnormally low interest rates, and capital gains exemptions for housing. For Renters: LOL gently caress you and buy a house already Or in graphical form:  The role of Education Student loans - Essentially these beat the real estate industry to the wallets of the millennial generation who are delaying major "life events" such as marriage, children, first house purchases, etc as a result of not having any god drat money. School districts - School district is a major driver of housing price and districts with hard boundary lines and little shared funding exacerbate this causing housing in a "good" district to be much more expensive. As an interesting result the NAR is pretty dead set against any decoupling of physical neighborhoods with school revenue (such as charter schools) because they will lose one of their best selling points. You want your kid to grow up to be smart, right? What's an extra $40k sales price (and $2.4k extra agent commission) compared to that? The lingering effects of systemic racism Blockbusting - During the period of white flight to the suburbs real estate agents would pick a white urban neighborhood and hire a black family to do things like push a baby stroller around to terrify the white residents into selling at fire sale prices and buying in the suburbs. The houses were then turned around and sold to minorities or their future landlords at quite profitable markups which then served to accelerate the white flight in adjacent areas. Comic book level evil poo poo. Redlining and reverse-redlining - Basically in the 60s banks and other institutions kept maps that indicated areas where they would not loan money. Of course they were pretty much “black people live here” maps, and the inability to get any financing in those zones is strongly believed to have caused urban blight and decay. Now however there is circumstantial evidence that banks actively target minority areas because they can be sold more profitable (worse) loans and products. Vacant housing and shadow inventory - The hangover from the just popped bubble: large numbers of houses which have either already been foreclosed on, are in the process of foreclosure/short sales, or will go on the market the instant the owner isn’t underwater (owes more than the house is worth) anymore. There are accusations that banks have been slowly metering out this supply to keep from utterly crashing the market but nobody knows for sure exactly how the market is being been impacted. Developer incentives for affordable units - In many areas of the country developers are strongly encouraged to incorporate “affordable” units into any large scale project in order to get juicy property tax exemptions or to gain zoning variances. However in the best tradition of loving over the poor it turns out that many of those deals didn’t preclude building ultra-utilitarian super-small units in “luxury” high rises. A new fun trend is complete segregation of market rate and affordable housing tenants, even going so far as banning affordable unit renters from the gym. Books of Interest The Two Income Trap by Amelia Warren Tyagi and Elizabeth Warren - Goes into detail about how going from one income households to two income households decreased families’ ability to absorb financial emergencies while massively inflating housing costs. The Death and Life of Great American Cities by Jane Jacobs - published in 1961, a classic teardown of segregated urban planning that is still depressingly relevant today. Crabgrass Frontier by Ken Jackson. Per Popular Thug Drink: I find him more approachable than Jacobs and while she writes about current principles of ideal urbanism, Jackson writes the only book you need to read about 20th century sprawl and why American cities are the way they are. Please forgive the brevity and sketch-like nature of this first post because every time I tried to write up something detailed it devolved into a massive clusterfuck. While that is a great reflection of the state of housing in the US it wasn’t exactly a good starting point for discussion. I figure we can roll with it and I'll update the post as interesting things are linked. In short take this filing from American Homes 4 Rent's IPO (one of those hedge-fund backed purchasers of houses):  poo poo is hosed up. Shifty Pony fucked around with this message at 00:17 on Jun 8, 2014 |

|

|

|

|

|

| # ? Apr 20, 2024 02:15 |

|

Thanks for the detailed OP. I don't have anything to add as of yet, but I'm grateful for the post because (as you know, Shifty) I live in Austin and things are nuts out here.

|

|

|

|

Shifty Pony posted:Millennials - Simply put are not buying houses like previous generations and the real estate industry is alternating between tut-tutting about how the drat kids will come around eventually and near panic about a massive slice of the market (starter homes) evaporating. The generation has been screwed in many ways economically: large debt loads from student loans leave little room in the budget for rent much less to save for any sort of down payment; jobs are hard to find and unreliable; parents are unable to help with down payments; and massive competition in many housing markets from hedge funds and flippers. As a millennial, my reason for not buying a house is simply that I find it dumb to tie myself down to one geographic area. I really enjoy the freedom of being able to move where jobs and opportunities are. I will buy a house only after I get married and become ready to have kids. When that happens, the value of stability will outweigh the value of aforementioned freedom. Until then, renting is the most economically sound decision. Xibanya posted:Thanks for the detailed OP. I don't have anything to add as of yet, but I'm grateful for the post because (as you know, Shifty) I live in Austin and things are nuts out here. I might be moving there soon. Can you elaborate?

|

|

|

enraged_camel posted:

If you want to rent a house (or some apartments) you likely will need to file an application to rent it before you see the unit. Occupancy is at 97% so you get zero negotiation on rent increases (often over 10-15%) or any terms at all really, if you don't like it there are 8 other people right behind you. Code enforcement is a joke so dangerous properties are everywhere. The local realtor group managed to get a rule change allowing up to 3% of the housing in the city to be taken off the market for people who actually live here and instead rented as short term vacation rentals for $10k+ per week for South by Southwest and F1 (because the realtors make bank managing those units for out of area investors and selling people on higher house prices by telling them they can rent out part of it for special event weekends). Neighborhood associations vehemently oppose any increase in density. If you want to buy a house for less than 300k (probably 350 now) in the city you better have cash or bid way over asking with no conditions because "buy to rent" or "demolish and rebuild as a luxury house" investors are everywhere and they do have cash. Houses in many neighborhoods are under contract in hours after listing, mostly because the real estate agents shop them around among other agents before listing them on the MLS, conveniently making online sites useless. Property taxes are skyrocketing as appraisals track the insane market, leading to my neighbor paying something like 7k per year in property tax. Oh and median income hasn't moved much if any.

|

|

|

|

|

Shifty Pony posted:Books of Interest I want to add to this Crabgrass Frontier by Ken Jackson. I find him more approachable than Jacobs and while she writes about current principles of ideal urbanism, Jackson writes the only book you need to read about 20th century sprawl and why American cities are the way they are.

|

|

|

|

Shifty Pony posted:If you want to rent a house (or some apartments) you likely will need to file an application to rent it before you see the unit. Occupancy is at 97% so you get zero negotiation on rent increases (often over 10-15%) or any terms at all really, if you don't like it there are 8 other people right behind you. Code enforcement is a joke so dangerous properties are everywhere. The local realtor group managed to get a rule change allowing up to 3% of the housing in the city to be taken off the market for people who actually live here and instead rented as short term vacation rentals for $10k+ per week for South by Southwest and F1 (because the realtors make bank managing those units for out of area investors and selling people on higher house prices by telling them they can rent out part of it for special event weekends). Neighborhood associations vehemently oppose any increase in density. Jesus.

|

|

|

|

Shifty Pony posted:If you want to rent a house (or some apartments) you likely will need to file an application to rent it before you see the unit. Occupancy is at 97% so you get zero negotiation on rent increases (often over 10-15%) or any terms at all really, if you don't like it there are 8 other people right behind you. Code enforcement is a joke so dangerous properties are everywhere. The local realtor group managed to get a rule change allowing up to 3% of the housing in the city to be taken off the market for people who actually live here and instead rented as short term vacation rentals for $10k+ per week for South by Southwest and F1 (because the realtors make bank managing those units for out of area investors and selling people on higher house prices by telling them they can rent out part of it for special event weekends). Neighborhood associations vehemently oppose any increase in density. The first and third paragraphs sound almost exactly like Portland! If it weren't for the SXSW reference, and the bit about property taxes increasing, nobody could have told the difference. I don't know about legally codifying units being taken off the market for the purpose of temporary rentals here, although it wouldn't be surprising, and Airbnb is moving their headquarters here anyway, so...

|

|

|

|

Shifty Pony posted:If you want to buy a house for less than 300k (probably 350 now) in the city you better have cash or bid way over asking with no conditions because "buy to rent" or "demolish and rebuild as a luxury house" investors are everywhere and they do have cash. Haha, 350k. You could buy maybe -- maaaybe -- a shack with that sort of money in LA, which is where I live now. So yeah, Austin seems quite affordable.

|

|

|

|

Hedera Helix posted:The first and third paragraphs sound almost exactly like Portland! If it weren't for the SXSW reference, and the bit about property taxes increasing, nobody could have told the difference. I don't know about legally codifying units being taken off the market for the purpose of temporary rentals here, although it wouldn't be surprising, and Airbnb is moving their headquarters here anyway, so... Oh yeah, if current trends hold then get ready for lower income households to get priced out of cities entirely and middle income households packed into the former ghettos. Impoverished urbanites will become impoverished suburbanites, living in badly maintained slums that were once mid-century first generation suburbs. All this and $7 gas, too!

|

|

|

|

enraged_camel posted:Haha, 350k. You could buy maybe -- maaaybe -- a shack with that sort of money in LA, which is where I live now. So yeah, Austin seems quite affordable. Even in the exurbs of Austin, it's bad. I lived in Georgetown and my rent was $670 for a 700 Sq ft 1/1. And this was a low-income property. You couldn't make more than like $28k (single, I forget the numbers for more people) and live there. Now I live in Southern Indiana and our 3/2 starter home is a little over $135k.

|

|

|

|

Does anyone have any of dm's stuff from 2009/2010? He had some effort posts on mortgage delinquency rates were skyrocketing, MERS, and how the Fed's assets were changed up after the bailout. That said, Bank of America is following Chase bank on the foreclosure crisis by doing a very expensive settlement. CNN Money posted:Bank of America is negotiating a deal with the Justice Department and a number of states that could lead to a roughly $12 billion settlement related to the bank's mortgage banking practices, according to a U.S. law enforcement official.

|

|

|

|

The part about student loans and Millennials is spot on. Me and my wife would gladly buy our own place if we didn't have a what amounts to the same in loan debt. All of my paychecks go towards beating on the loan payments while we live off my wife's income. Thankfully Im paying 4 times the minimum on the worse loans to get them off of us as fast as I can. My area as a ton of house sitting vacant that no one has any idea who owns. House next door would be a perfect buy for us and would be 60 thousand but its been empty for 5 years and I've never found any info on the house on who owns it or a realtors office on whos trying to sell it. there's hundreds of homes like that around us. Still better then what you guys are saying of Austin or the clusterfuck the west coast is. Most of the houses in northeast Ohio can be bought for less then 100 thousand if your smart and don't buy split levels.

|

|

|

|

UCS Hellmaker posted:The part about student loans and Millennials is spot on. Me and my wife would gladly buy our own place if we didn't have a what amounts to the same in loan debt. All of my paychecks go towards beating on the loan payments while we live off my wife's income. Thankfully Im paying 4 times the minimum on the worse loans to get them off of us as fast as I can. Your county might have property ownership records available. For instance I can go on the Maricopa county website to see who owns the house that is being rented across the fence. Also unless you want to be swimming in rehabilitating a place, don't buy anything that's been vacant for 5 years. You'll want at least 15 or 20 thousand dollars on top of sale price over a couple years. poo poo that's not maintained just stops working when it's not in use

|

|

|

|

Shifty Pony posted:If you want to rent a house (or some apartments) you likely will need to file an application to rent it before you see the unit. Occupancy is at 97% so you get zero negotiation on rent increases (often over 10-15%) or any terms at all really, if you don't like it there are 8 other people right behind you. Code enforcement is a joke so dangerous properties are everywhere. The local realtor group managed to get a rule change allowing up to 3% of the housing in the city to be taken off the market for people who actually live here and instead rented as short term vacation rentals for $10k+ per week for South by Southwest and F1 (because the realtors make bank managing those units for out of area investors and selling people on higher house prices by telling them they can rent out part of it for special event weekends). Neighborhood associations vehemently oppose any increase in density. The council is also lowering the occupancy limit in my neighborhood (78751) because the neighborhood association was complaining about too many students in one house. So I'm in store for even more rent increases. All these fucks need to go back to California.

|

|

|

|

Badger of Basra posted:The council is also lowering the occupancy limit in my neighborhood (78751) because the neighborhood association was complaining about too many students in one house. So I'm in store for even more rent increases. All these fucks need to go back to California. Why homeowners associations exist in America and why does anyone care about them

|

|

|

|

blowfish posted:Why homeowners associations exist in America and why does anyone care about them To preserve ~*property value*~, the biggest store of wealth for middle class people, as well as allow us to be petty fascist dicks at each other for a good cause. HOAs can be useful when your neighbor decides to open a freelance junkyard in their driveway but the other end of the spectrum is getting dinnertime knocks and lectures which threaten fines for leaving your garage door open and your yard grass 3/16th of an inch too long.

|

|

|

|

I wish a "right to live" law was introduced into every state that has "right to work" If Union membership must be optional then HOA membership should work the same way

|

|

|

|

Badger of Basra posted:The council is also lowering the occupancy limit in my neighborhood (78751) because the neighborhood association was complaining about too many students in one house. So I'm in store for even more rent increases. All these fucks need to go back to California. Hey now, we don't want them either. Let Arizona or New Mexico have them.

|

|

|

|

MickeyFinn posted:Hey now, we don't want them either. Let Arizona or New Mexico have them. New Mexicans want neither Texans nor Californians. It'll have to be Arizona.

|

|

|

|

ComradeCosmobot posted:New Mexicans want neither Texans nor Californians. It'll have to be Arizona. gently caress. Can we corral them all in Sun City and then lower a concrete sarcophagus on the entire community?

|

|

|

|

I got my 3 years ago house at 23 with my wife. The HOA we have is something i don't mind, they keep the trails maintained and roads plow since the city is unable to do it. I feel that their spy tower on the adjacent mountain is a bit over the top. I notice that my friends the same age have major student loans and still live with their parents and they cant find any jobs related to their degrees. I am entering my 7th year of my 4 year degree because i cant afford to go time but i don't have any student loans to worry about. Hopefully change to student loans come to soon before the bubble bursts.

|

|

|

|

Dr. Arbitrary posted:I wish a "right to live" law was introduced into every state that has "right to work" I guess being from where I am from(Detroit area, now upper peninsula of Michigan) I never really realized HOA's were a thing. Are they basically in all "nice" neighborhoods in all large cities around the country? I lived in Dallas and Phoenix, but I rented both times so I never heard anything about it. The idea of it sounds totally foreign and crazy to me. I am probably just weird though. I just bought my first house, but it's old and tiny, and obviously there is no HOA involved here. Can someone explain how they work? They are mandatory to join to live in certain areas I take it? edit: as I am googling about them, it sounds crazy.

|

|

|

|

Dr. Arbitrary posted:gently caress. I know a ton of people who would back that option, myself included.

|

|

|

|

HOA from my current experience are pretty friendly if you work with them. If i don't take care of my yard they will give plenty of opportunities to fix it, or they charge fines and eventually put a lien on your house. Also its like the inquisition where your neighbors tattle on you for not following rules. Mow your lawn and get your fence approved and you are fine.

|

|

|

|

Another Gen-X/Millennial chiming in (I'm turning 33 later this month). Student loans, car loans, and a credit card are all the debt I can legitimize. Even facing arguments about "home equity", there is NO WAY I'm buying a home in the next decade. Renting, I don't have to worry about poo poo. Just a monthly payment. No insurance, no tax bill at the end of the year, no maintenance. And if I want to move, I can. All I have to do is not renew my lease. On the negative side, rents are creeping up, even for poo poo apartments. To get a real swank place here, you need to spend $2500/mo. I'm in a 2/1.5 with my girlfriend and a roommate right now, paying $930/mo because it's in the ghetto right next to I-95. Air quality is poo poo, and there are no amenities. The only thing going for it is that I'm around the corner from my office and we can get on the highway very quickly.

|

|

|

|

Does anyone know how housing/rent stuff is in San Antonio? I'm not yet in the "real world" but I was planning on staying there for a few years until I had job experience to move out to Oregon.

|

|

|

|

I bought a house because I could afford it and I couldn't afford rent. Even with the maintenance that I've had to do, I've come out ahead vs. renting. I've got a kid and I work from home, and affordable 3br rental housing basically don't exist in DC. e: which is to say that I'm more concerned about the Rent Is Too drat High than the price of housing stock, given that nobody has a down payment anyway. WhiskeyJuvenile fucked around with this message at 14:15 on Jun 7, 2014 |

|

|

|

computer parts posted:Does anyone know how housing/rent stuff is in San Antonio? I'm not yet in the "real world" but I was planning on staying there for a few years until I had job experience to move out to Oregon. Rents cover a pretty broad range... ignoring the lowest end and most run down places, you can expect to pay anywhere from $750 to close to $2000/month in rent for an apartment or townhouse. A moderate 4 bedroom house will run you anywhere from $185k to about $300k depending on location, lot size and the perks you want to add. At current rates that $300k house will run you around $1250/month plus taxes and insurance assuming you can hit a 20% down payment and avoid PMI (gently caress PMI, seriously).

|

|

|

blowfish posted:Why homeowners associations exist in America and why does anyone care about them These are neighborhood associations, a slightly different animal than homeowners associations. They are essentially there to cloak the demands of the richest owners in the veneer of representing the will of the entire neighborhood. Austin city council is composed entirely of at-large members, and elections are held on non-presidential years in May. Turnout is around 3 percent of eligible voters versus 80 in presidential elections. Three neighborhoods essentially run the election, and the richest people vote with more regularity. Recently things have changed and elections are switching to 10 geographic districts with elections in November. Those who had the ear of all the council are really really frightened now and trying to slam in as much of what they want before the elections happen. Homeowners associations are actually required by many cities and counties in the US. Building out and maintaining infrastructure for suburbs is absurdly expensive so cities are having none of that. But give people one iota of power and bad poo poo can happen.

|

|

|

|

|

Badger of Basra posted:The council is also lowering the occupancy limit in my neighborhood (78751) because the neighborhood association was complaining about too many students in one house. So I'm in store for even more rent increases. All these fucks need to go back to California. Proof that every state has their own natetimm.

|

|

|

|

Dirt posted:I guess being from where I am from(Detroit area, now upper peninsula of Michigan) I never really realized HOA's were a thing. Are they basically in all "nice" neighborhoods in all large cities around the country? I lived in Dallas and Phoenix, but I rented both times so I never heard anything about it. You are pretty much forced to join the HOA and abide by all the covenant rules covering things like home maintenance if you buy a house in addition to paying a monthly fee. It's not something you can opt-out

|

|

|

|

I'd like to talk about a broader topic, which is how on earth does the idea of housing prices going up being a good thing persist? I know this is the line the Realtors (and boomers) are pushing, but it seems to completely dominate the media and public discourse. Even news programs on NPR will talk about the economy improving because the housing market is "recovering" and prices are going up. You never hear such nonsense with other necessities -- imagine the absurdity of your news anchor telling the public "Good economic news everybody: food and gas prices are both going up!" Yes, that may be good news to current homeowners looking for equity, but unless you are either old or a bank it's much more likely to be bad news. Perhaps we'll see a shift in the discourse sooner or later?

|

|

|

|

Popular Thug Drink posted:To preserve ~*property value*~, the biggest store of wealth for middle class people, as well as allow us to be petty fascist dicks at each other for a good cause. Pretty much every city and town already has actual laws on the books to keep rednecks from turning their lawn into a junkyard. HOAs pretty much exist to keep people from painting their house a weird color.

|

|

|

|

ShadowHawk posted:I'd like to talk about a broader topic, which is how on earth does the idea of housing prices going up being a good thing persist? I know this is the line the Realtors (and boomers) are pushing, but it seems to completely dominate the media and public discourse. Because home prices are correlated with demand so if a lot of people want to live somewhere the price will go up. It's not the same as food because it's not a perishable item and it's not the same as an automobile because you can take your car basically anywhere with you.

|

|

|

|

computer parts posted:Because home prices are correlated with demand so if a lot of people want to live somewhere the price will go up.

|

|

|

|

Shifty Pony posted:Government support of homeownership - For homeowners: the mortgage interest deduction, Federal backing of most mortgages, abnormally low interest rates, and capital gains exemptions for housing. For Renters: LOL gently caress you and buy a house already. Although it's related to business realty, the Section 1031 like-kind exchange tax deferral mechanism is probably the biggest governmental support mechanism (and how guys like Harry Helmsley, the Trump family and Sheldon Adelson built up their real estate empires).

|

|

|

|

ShadowHawk posted:Increasing prices can be signals of increased economic activity, which makes them a potential indicator of the health of the economy - this also applies to energy costs. The problem is that housing prices seem to be thought of as a cause of economic growth rather than a reflection of it. You will never hear a news anchor report that the economy will recover once we figure out a way to raise energy costs, but you hear this line about home prices all the time. Energy prices are much easier to manipulate on a global scale though. Plus consumers are much less sensitive to real estate price changes than fuel changes - if your house doubles in price, your mortgage doesn't change, only some property taxes (which vary by state). If your gas bill doubles in price, you're in trouble.

|

|

|

|

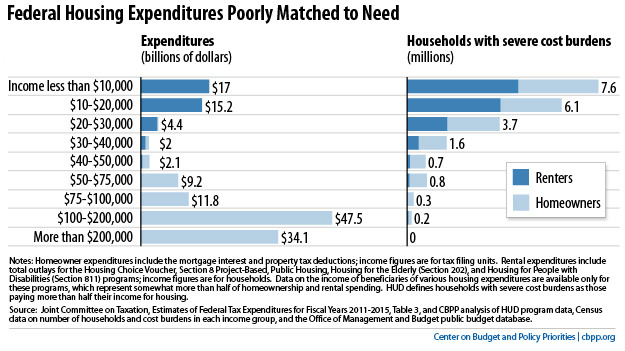

Shifty Pony posted:Government support of homeownership - For homeowners: the mortgage interest deduction, Federal backing of most mortgages, abnormally low interest rates, and capital gains exemptions for housing. For Renters: LOL gently caress you and buy a house already. Speaking of housing support, true to our nature, we spend more subsidizing the homes of the top 5%-10% of income earners than we do on public housing and private ownership by low/middle class people combined.  (X)

|

|

|

|

Amused to Death posted:Speaking of housing support, true to our nature, we spend more subsidizing the homes of the top 5%-10% of income earners than we do on public housing and private ownership by low/middle class people combined. it's basic math things like the homeowner tax deduction cost much more for higher bracket earners.

|

|

|

|

|

| # ? Apr 20, 2024 02:15 |

|

ShadowHawk posted:Increasing prices can be signals of increased economic activity, which makes them a potential indicator of the health of the economy - this also applies to energy costs. The problem is that housing prices seem to be thought of as a cause of economic growth rather than a reflection of it. You will never hear a news anchor report that the economy will recover once we figure out a way to raise energy costs, but you hear this line about home prices all the time. It used to be that housing rose something like 1% a year. So, if wages kept up with a few percent or more inflation then housing costs increasing weren't really a big deal. However, for the last 30 years (or more) wages have been stagnant and housing has been looked at as a way to increase income for the middle class, just like credit cards. Along with the financialization of housing (buying up housing and then renting it), this means that housing is now an income stream for current owners. You are right that it is insanely short sighted, but you have to keep dancing even though the music has stopped if you want to buy a house.

|

|

|

I CANNOT EJACULATE WITHOUT SEEING NATIVE AMERICANS BRUTALISED!

I CANNOT EJACULATE WITHOUT SEEING NATIVE AMERICANS BRUTALISED!