|

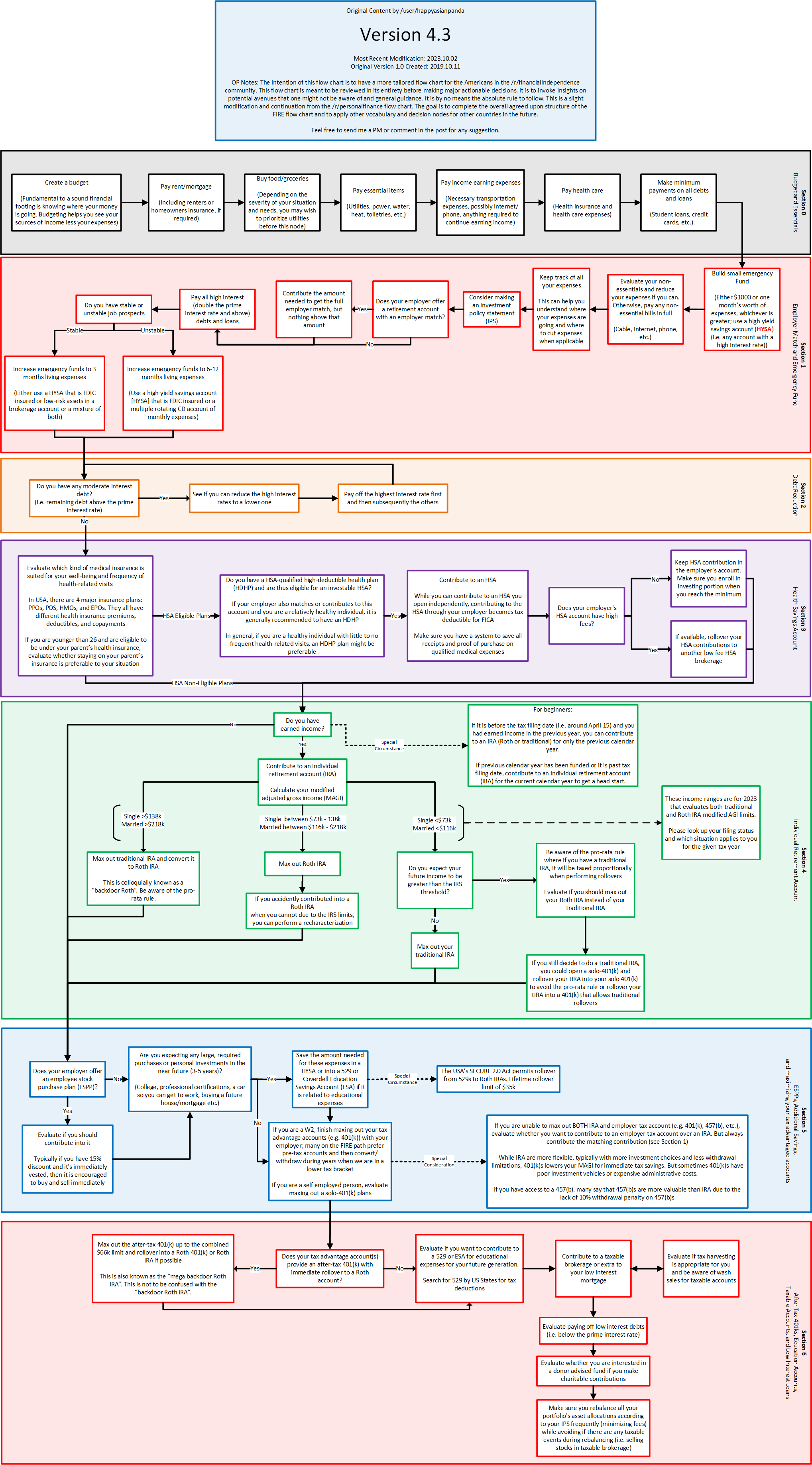

Welcome to the long-term investing & retirement thread. Here is the place to get suggestions on how to set up your 401k, or IRA, or taxable accounts including short-to-medium term savings as part of a larger portfolio.Benjamin Graham, The Intelligent Investor, revised edition, pg. 205 posted:"The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements." Some of the people who post here have actual financial training but most do not. Some of us are quite cynical about the financial advice industry, some are not. Take any advice with a grain of salt and consider the source. NOTE! This is generally a USA-centric thread. BFC has a Canadian thread on the same topic, as well as a UK thread. If you're from some other country, feel free to ask questions here, but most of the advice in the OP and other posts may not apply. Wow, this is complicated. I heard there are books I could read but isn't there something quicker? Start at the SEC page on introduction to investing for basic roadmaps, terms, and educational info: https://www.investor.gov/introduction-investing GoGoGadgetChris posted:Bernstein (author of Four Pillars) also wrote a short eBook "If You Can": http://www.etf.com/docs/IfYouCan.pdf If You Can is a great primer. It's written specifically for young investors. PSL posted:Can we update the OP to include the Stock Series at jlcollinsnh? I feel like telling people "read a whole book" is not always the best way to start them off when they come in with basic questions. Parts I-VI of the Stock Series are especially good for someone who's just beginning their exploration. https://investor.vanguard.com/investor-resources-education How much should I be saving? This depends totally on your individual goals, age, and risk tolerance. It stands to reason that if you are 22 years old and don't want to retire for 40 years, your needs are going to be different than the poor schmuck that is just starting to save for retirement at 50 years old. That said, if you are young and fairly new in your career, which you most likely are if you are reading this forum, 10% of your pre-tax salary is an absolute baseline minimum amount that you should be saving. The more aggressively you save on top of that, the better off your long-term financial outlook will be. IRS page on savings for retirement: https://www.irs.gov/retirement-plans/plan-participant-employee/saving-for-retirement Here is a decent calculator to help you run different savings scenarios. I'm in my early 20s, why do I need to save for retirement? Compounding interest is a wonderful thing when it works in your favor. Consider this scenario: Let's say there is a 25 year old kid that is making $50k per year. He starts contributing 10% of his salary to a 401k plan every year, until he retires at 65. Assuming that his salary remains equal to inflation, he will retire at 65 with about $2 million in savings, assuming an average 8% return. If he starts saving later, he will have to save much, much more per year to reach the same target. The market is getting killed, shouldn't I wait it out for a while? No. Consider this somewhat-famous Warren Buffet quote: quote:To refer to a personal taste of mine, Iím going to buy hamburgers the rest of my life. When hamburgers go down in price, we sing the ĎHallelujah Chorusí in the Buffett household. When hamburgers go up in price, we weep. For most people, itís the same with everything in life they will be buying ó except stocks. When stocks go down and you can get more for your money, people donít like them anymore. Roth IRAs, 401(k)...I'm confused. Where do I start? There are two basic types of savings accounts -- tax-advantaged, and taxable. Tax-advantaged savings are where you will most likely be doing the grand majority of your savings until later in your career. There are 3 main types of tax-advantaged savings accounts -- Roth IRA, Traditional IRA, and 401(k) (or equivalent). I could explain all of these in detail, but Nerdwallet has already done a pretty good job right here. Also, the St. Louis Fed discusses retirement account basics here: https://research.stlouisfed.org/pub...bout-retirement In general, most people would want to follow these rules: 1) Contribute to 401(k) up to employer match. Always get the free money! 2) Max out Roth IRA ($6,000 limit in 2022). You can skip this if your 401k options are good and you don't need the extra tax-advantaged space. 3) Max out 401(k) ($20,500 limit for 2022) 4) If you were able to finish Step 3, you will end up rich in all likelihood. There are a couple of frequently cited flowcharts from reddit, applicable to US residents: financial independence -- updated 2023!  look at this flow chart! use this! look at this flow chart! use this!  , , and personal finance (updated 2017),  And if you've used up all your tax-advantaged space and still want to save more, read the Boglehead wiki page on tax-efficient fund placement! Or at high income brackets, you may be interested in the a backdoor Roth or mega-backdoor Roth as described at their respective Bogleheads wiki pages. In general, people should visit the bogleheads wiki: https://www.bogleheads.org/wiki/Getting_started I have all these different funds to choose from, where do I start? This is where the fun begins. Vanguard's target retirement funds are a great place to start if you are a passive investor. That said, if you are investing in 401(k), there's a good chance that you will have very limited options. In general, all long-term investors should have some exposure of U.S. equities, international equity, and fixed income. The exact ratios again depend on your age, goals, and risk-tolerance. I am 25 years old and I try to keep to my plan of 45% intl equity/40% US equity/15% fixed income. Another easy starting place are the so-called Lazy Portfolios - that page actually discusses several different strategies, any of which could be a good starting point (except maybe putting 25% of your portfolio in gold). If you know what portfolio you want and are trying to make it fit into the lovely options of your work 401k, there are some suggestions in the lazy portfolio section of the Boglehead wiki. There is also a portfolio calculator tool over at Morningstar that you can use to compare your hacked-together portfolio with whatever index you are trying to approximate. I should get a whole life / universal life insurance policy to keep everything simple, right? No you shouldn't. Here is a post about how insurance works. I have time to read an actual book - but which one? Fundamentals Intelligent Investor https://www.amazon.com/Intelligent-Investor-Definitive-Investing-Essentials/dp/0060555661 The Four Pillars of Investing https://www.amazon.com/Four-Pillars-Investing-Building-Portfolio/dp/0071747052/ The Bogleheads' Guide to Investing http://www.amazon.com/Bogleheads-Guide-Investing-Taylor-Larimore/dp/1118921283/ Deeper Cuts Stocks for the Long Run https://www.amazon.com/Stocks-Long-Run-Definitive-Investment/dp/0071800514 A Random Walk Down Wall Street http://www.amazon.com/Random-Walk-Down-Wall-Street/dp/0393340740/ The Psychology of Money https://www.amazon.com/Psychology-Money-Timeless-lessons-happiness/dp/0857197681 Why Smart People Make Big Money Mistakes http://www.amazon.com/Smart-People-Money-Mistakes-Correct/dp/B00150D6KU/ Economic Interest Why Minsky Matters https://www.amazon.com/Why-Minsky-Matters-Introduction-Economist/dp/0691159122 Devil Take the Hindmost http://www.amazon.com/Devil-Take-Hindmost-Financial-Speculation/dp/0452281806/ Against the Gods http://www.amazon.com/Against-Gods-Remarkable-Story-Risk/dp/0471295639/ A Splendid Exchange http://www.amazon.com/Splendid-Exchange-Trade-Shaped-World/dp/0871139790/ ...if you're looking for data, not a book, check out FRED: https://fred.stlouisfed.org/ Where can I open an account? If we're talking taxable brokerage accounts or IRAs, the three most popular sites are: Schwab (note, TD Ameritrade was bought by Schwab) https://www.schwab.com/client-home Vanguard https://investor.vanguard.com/home Fidelity https://www.fidelity.com/ ...but there are several other brokers including services from major Wall Street banks. Help, I don't understand bonds! A lot of people don't. Here are some basics on bonds and some math on understanding bond yield and coupons. Here's the Treasury Direct site discussing savings bonds, including EE and I-Bonds. Bonds have different risks than stocks, but risks nonetheless. Some of those risks, such as interest rate risk, are discussed here and here. You may hear of people managing some of this risk by creating "ladders" with savings bonds (in 2022, I-Bonds), CDs, Treasurys, or bond funds. Read up on ladders at these pages: https://www.fidelity.com/viewpoints/investing-ideas/bond-ladder-strategy https://investor.vanguard.com/investor-resources-education/online-trading/bond-strategies https://www.schwab.com/fixed-income/bond-ladders https://www.ishares.com/us/strategies/bond-etfs/build-better-bond-ladders Some more I-Bond specific discussion is here: https://tipswatch.com/i-bond-manifesto/ I want to buy something pricey in a few years or save for medium-term, should I just dump my money in the market? Probably not. This is not a one size fits all thing, post your question in thread. Where is the best HYSA yield? HYSAs or money market funds are typically backed by federal reserve funds or Treasury Bills, and in general you won't be able to find total return any better than a simple Treasury Bill ETF like BIL or SGOV: https://www.ssga.com/us/en/individual/etfs/funds/spdr-bloomberg-1-3-month-t-bill-etf-bil https://www.ishares.com/us/products/314116/ishares-0-3-month-treasury-bond-etf Regardless, HYSA interest rates will bounce around on a monthly basis and it's probably not worth yield chasing by frequently shifting money among accounts. Are many financial planners overpriced? yeah, probably: https://www.whitecoatinvestor.com/most-financial-planning-fees-are-excessive/ Iím in my mid 40s, is it too late for me? No! The best time to begin investing was yesterday; the second best time is now. Somebody fucked around with this message at 20:45 on Apr 29, 2024 |

|

|

|

|

| # ? Jun 13, 2024 16:21 |

|

Yay! I was contemplating making a thread like this myself. Any suggestions for good Roth IRA providers for someone that is planning on withdrawing some principle in a few years for, say, a house down payment? I was doing a little research and Oppenheimer seems to have a lot of options, but Vanguard seems to like pushing their low expense ratios. Basically, who's good for general Roth services and doesn't give you a hard time over withdrawals (if this ever happens)? If they have decent fixed-rate options (CDs, Bonds, what have you) as well, that's a plus. I tend to like to put new money into that while the market is doing lovely or just really volatile.

|

|

|

|

Just looking for some opinions on what I currently hold and my approximate allocations: VFINX - Vanguard 500 Index Fund - 25% VEXMX - Vanguard Extended Market Index Fund - 25% VWIGX - Vanguard International Growth Fund - 25% VEIEX - Vanguard Emerging Markets Stock Index Fund - 25% I'm 23 years old and don't have any plans for any large purchases (a house, etc.) in the near future. I feel I may be a little too heavy on the emerging markets and am thinking about rebalancing by adding VTRIX soon, but I still want to maintain a 50/50 split between domestic and international equities. My proposed rebalancing would be: VFINX - 25% VEXMX - 25% VWIGX - 20% VTRIX - 20% VEIEX - 10% Does this sound reasonable assuming this money is currently just being saved for retirement?

|

|

|

|

VEIEX has been doing incredibly well for me, I wouldn't take anything away from that. I did the domestic/international split with a slight bias towards international equities and it's been pretty positive so far.

|

|

|

|

Is there any point to a 457 plan? It seems you are limited to investments off a list with relatively high expenses. With the required tmrs, i put 1 part in and the city puts 2 parts in, so that is pretty good, 5% of my income is contributed at 15% in reality. But i'm trying to decide how else to save? I guess $5000 into a roth ira would be best since i'm at a lower income level?

|

|

|

|

Christobevii3 posted:Is there any point to a 457 plan? It seems you are limited to investments off a list with relatively high expenses. With the required tmrs, i put 1 part in and the city puts 2 parts in, so that is pretty good, 5% of my income is contributed at 15% in reality. But i'm trying to decide how else to save? The general wisdom is to contribute just enough to your 401(k) or 457 to get the maximum matching that your employer offers. Then funding a Roth IRA to the max is a good idea. If you think you'll be in a higher tax bracket in the future, a Roth IRA is beneficial because you pay taxes once now, and then you get to take all the money out later tax-free. If you have any left after that, you can go back and put it in your 457, but like you said, you have limited investment options there.

|

|

|

|

Taking compound interest into consideration, does it make sense to max out a Roth IRA each year before paying off debts (school loans, on average 4-5%), or dumping everything into the debts first (3-4 years to get them all paid off)?

|

|

|

|

dysaio posted:Taking compound interest into consideration, does it make sense to max out a Roth IRA each year before paying off debts (school loans, on average 4-5%), or dumping everything into the debts first (3-4 years to get them all paid off)? Personally, I'm contributing enough to max out the company match on 401k and then overpaying what I can on my loans (also at 5-6%) to get rid of them. For now, I don't think you can do much better than a guaranteed 5% return when the S&P 500 is down over 10% for the year.

|

|

|

|

JohnnySavs posted:Yay! I was contemplating making a thread like this myself. I don't think that it much matters where you open up your Roth. I used to be with ING, and then switched it over to Vanguard since they provide much better analysis. Oh, and I have a huge hard-on for Vanguard. That said, I disagree with using a Roth to house income that you will eventually use in a few years for a house. There are a few reasons: 1) Retirement savings should be made separately from savings for other purchases such as a home. Even if you are trying to save for a house, you should ALWAYS put a minimum of 10% of pre-tax income against retirement. Your Roth IRA should not be a short term savings vehicle. 2) Your savings goals are very different for retirement vs. buying a house in a few years. If you are trying to save up for a house, your money should be in CDs, bonds, money market, etc. Long term savings should be mostly equity at this point. Trying to create some type of weird blended portfolio in a Roth is not really going to work for you. You don't need to be in a huge hurry to buy a house. I know the market looks low right now and it is tempting. But in all honestly renting has a lot of very important, often overlooked benefits that you don't realize until you buy your first place. Be patient, build a good down payment that is independent of your retirement savings, and make sure you have a reasonable emergency fund in place before you make the decision to buy. [panic] fucked around with this message at 13:13 on Jul 4, 2008 |

|

|

|

Mind_Taker posted:Just looking for some opinions on what I currently hold and my approximate allocations: That portfolio looks just OK, but I think you can do better. You have been in VWIGX and are considering VTRIX, both of which carry high-ish expense ratios that are twice something like VGTSX, which is the Vanguard Total International Stock Market Index. I just checked the charts and over 5 years, VGTSX has outperformed VTRIX by 20% and VWIGX by 40%. That said, I think you have the right idea with a high international asset allocation. Personally, I would set up your AA with something like: VFINX 25% VEXMX 20% VGTSX 35% VEIEX 10% VBMFX 10% That gets you a balanced U.S. vs. international allocation, with a slight over-index towards emerging markets, which I still believe is a good play. I also added a small allocation in bonds. Research has shown (though I can't find the drat link at the moment) that this helps mitigate risk over a long-term, while not really having a significant effect on long-term earning power. Hope this helps! edit: Here is an awesome link explaining more about Vanguard's international funds in detail. [panic] fucked around with this message at 17:25 on Jul 4, 2008 |

|

|

|

Is there something I can contribute to in lieu of a 401(k) if I am a 1099 worker? Edit: To clarify, I plan to contribute more than $5,000 to my retirement this year but of course I can only contribute that much to my Roth IRA. I was wondering if there is some other tax shelter I can set up for my retirement savings. palatka fucked around with this message at 15:39 on Jul 4, 2008 |

|

|

|

palatka posted:Is there something I can contribute to in lieu of a 401(k) if I am a 1099 worker? There is a single participant 401(k) plan available for independent contractors. Here is some information you can read up on. If you are interested in going this route, I would recommend calling Vanguard or Fidelity or whoever you would want to set the 401(k) up with, and they should be able to walk you through the process, including which forms need to be filled out and all of that fun stuff.

|

|

|

|

Does anyone have any tips for starting up a roth ira? Ideally I'd like to have a mix of different funds, but most of them have some sort of minimum investment and you can only contribute $5,000 per year right?. It seems like it would take 2-3 years before I could have 4 or 5 different funds in my portfolio. I'm just worried about screwing myself over by starting out with just one fund.

|

|

|

|

ZeroAX posted:Does anyone have any tips for starting up a roth ira? Ideally I'd like to have a mix of different funds, but most of them have some sort of minimum investment and you can only contribute $5,000 per year right?. It seems like it would take 2-3 years before I could have 4 or 5 different funds in my portfolio. I'm just worried about screwing myself over by starting out with just one fund. There are plenty of very good funds in which you could invest that will keep you fully diversified up until whatever point you have enough money banked to start slicing and dicing on your own. I know that I sound like a total shill for Vanguard in this thread, but their Target Retirement funds are a really great place to start. They definitely aren't the only company that offers these types of funds, but they have the lowest fees. That said, I think they under-index on international, so they aren't perfect. You might be able to find something with a better mix by hunting around, but early in your career I believe it is just more important that you are saving with a decent asset allocation, rather than trying too hard to slice and dice your way to the perfect portfolio.

|

|

|

|

"[panic posted:"] Thanks, thats a good idea. I just remembered I have a Roth IRA with Schwab that has about $4,000 that my grandpa set up for me many years ago. I wanted to set up a Vangaurd account and roll over my old roth ira into it. When I try to set this up I get a message saying "Your financial institution won't move your holdings directly into Vanguard funds. You'll need to sell your assets and move them into cash or a money market prior to the transfer. Contact a Vanguard associate at 800-669-8623 for help. We'll set up a conference call with you and your current financial institution to start the transfer." Is this going to trigger additional tax liability/penalties for selling off my ira instead of rolling it over?

|

|

|

|

ZeroAX posted:Thanks, thats a good idea. I'm not sure, but it looks like they're saying that maybe Vanguard can't hold the funds you currently have with Schwab. It sounds like you can still roll it over, but you have the sell the funds first. This could have tax implications -- I'm not sure -- but at least you won't be withdrawing the money and facing penalties for that. Of course, you'll probably want to check with Vanguard for the details. I'm just guessing here.

|

|

|

|

VERTICAL WIPE! posted:I'm not sure, but it looks like they're saying that maybe Vanguard can't hold the funds you currently have with Schwab. It sounds like you can still roll it over, but you have the sell the funds first. This could have tax implications -- I'm not sure -- but at least you won't be withdrawing the money and facing penalties for that. No, it seems pretty clear that he is not trying to move his fund shares over "in kind", but wants them going into Vanguard funds. So it has nothing to do with the funds that he is holding at Schwab. This is a Schwab policy, and not a Vanguard one (Vanguard simply knows that Schwab has this policy and is letting you know). Vanguard would be perfectly happy to send instructions to Schwab to liquidate the funds and transfer the money to Vanguard to be invested into Vanguard funds. However, Schwab doesn't like those types of instructions, and would prefer that the client put in a sell-order to sell his fund shares, have it go into the cash settlement account, and THEN have instructions to transfer the money over to Vanguard. I have had this issue before (Fidelity used to let me stay invested until the day Vanguard asks for the transfer, but now Fidelity wants their clients to sell first, and then initiate the transfer). It is no big deal. There are no tax liabilities involved here. You sell the funds, and it goes into a cash settlement account, but it's all done under the shelter of your IRA, and is not a taxable event. 80k fucked around with this message at 04:00 on Jul 6, 2008 |

|

|

|

80k posted:No, it seems pretty clear that he is not trying to move his fund shares over "in kind", but wants them going into Vanguard funds. So it has nothing to do with the funds that he is holding at Schwab. Thanks for clearing this up.

|

|

|

|

|

| # ? Jun 13, 2024 16:21 |

|

My portfolio is pretty typical for long-term strategy in early career (mix of growth/value, mix of large/small cap, mix of domestic and international). I don't have any emerging market funds and using the Yahoo! mutual fund tool and searching by morningstar ratings, load, etc. the top funds are either closed or not available through Schwab. I've seen the Vanguard index here, but does anyone have recommendations either for other general emerging markets funds or for one that focuses on India/China/Russia +/- Brazil? It's just a small amount (this year's Roth) but I want to fully diversify!

|

|

|