|

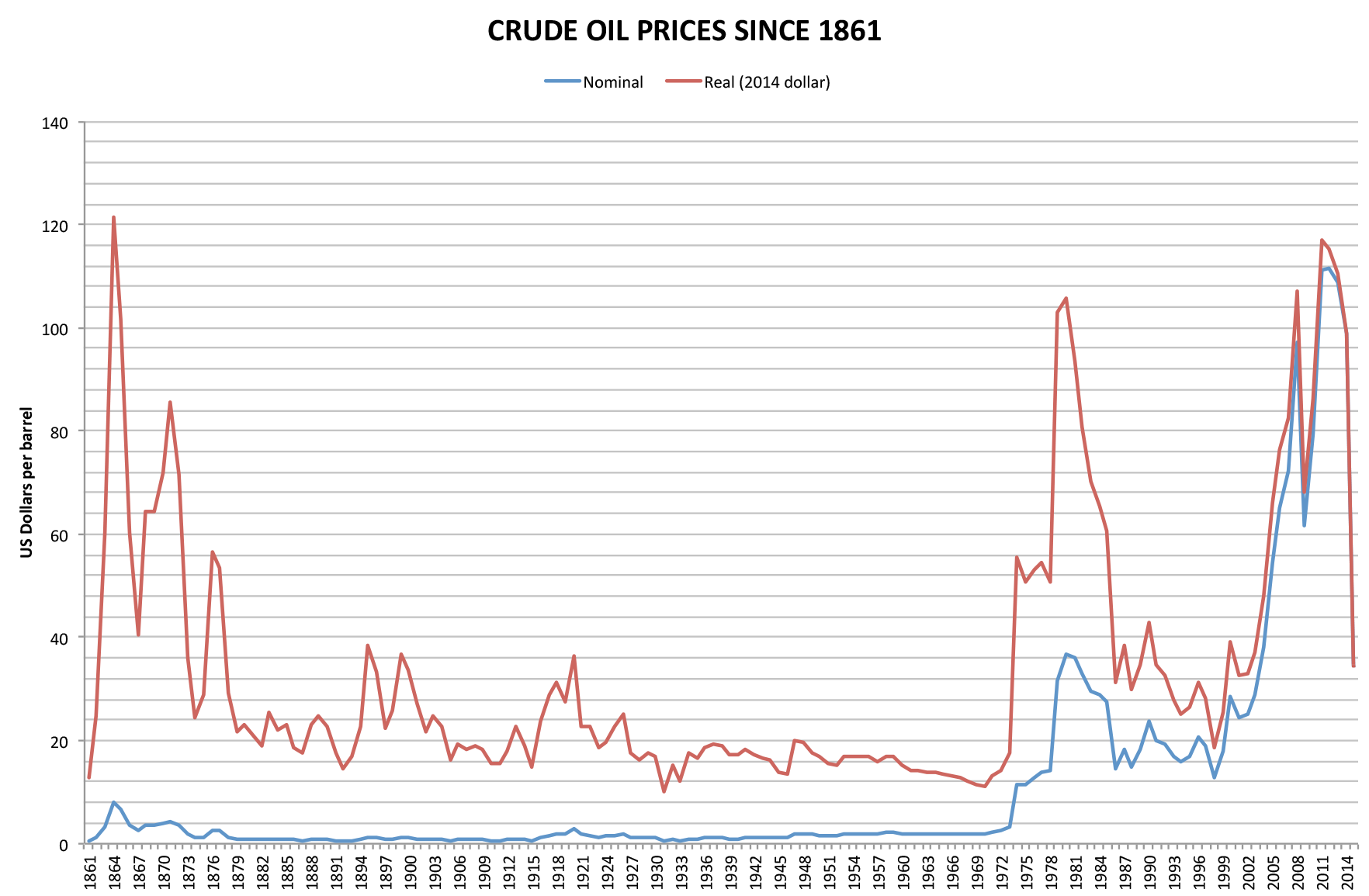

Zeroisanumber posted:Fracking is one reason, the complete collapse of cohesion among members of OPEC is another.

|

|

|

|

|

| # ? Apr 26, 2024 17:13 |

|

Related: http://nymag.com/daily/intelligencer/2016/01/next-financial-crisis-is-nigh-rbs-warns.htmlNY Mag posted:Roberts said that all of the red flags the bank has been monitoring — collapsing oil prices, volatility in China, rising debt, deflation, and weak corporate loans — have made their presence felt in the very first week of trading. The FTSE is already down 5 percent, its worst start since 2000, while the Dow Jones industrial average has never opened a year this poorly. How would this crisis, if it happens, be different from the last one? And what is a "Goldilocks love-in"?

|

|

|

|

gaj70 posted:The leadership of Iran/Russia, on the other hand, probably need the revenue to even maintain their geopolitical positions... Which is what this is about. Saudi Arabia is fighting a proxy war against Russia and Iran in Syria. By tanking the oil market SA puts direct pressure on both Russia and Iran.

|

|

|

|

This is probably the first time I've had a positive opinion of something SA did.

|

|

|

|

MaxxBot posted:This is probably the first time I've had a positive opinion of something SA did. Rich "Oiltax" Kyanka

|

|

|

|

I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. How dumb is this idea?

|

|

|

|

Ramrod Hotshot posted:How would this crisis, if it happens, be different from the last one? Probably the biggest difference is that the global economy has made a "recovery" in name only since 2008, with nearly every country in the world doing worse in terms of GDP growth than their pre-2008 levels and not getting anywhere near back to where they once were. Only the United States has seen respectable recovery, but it's still well below historical averages. The lack of major profitable investment opportunities is going to be even more keenly felt this time around now that China is on the ropes. At least post-2008 had the seemingly endless Chinese Miracle to prop up investor hopes. Where are they going to put their money now?

|

|

|

|

So will this gently caress over Hillary in the general?

|

|

|

|

Venomous posted:So will this gently caress over Hillary in the general? No, why would it? Maybe if Saudi Arabia actually fully implodes in the next 9 months, but otherwise it will probably be positive for the American economy Vermain posted:Probably the biggest difference is that the global economy has made a "recovery" in name only since 2008, with nearly every country in the world doing worse in terms of GDP growth than their pre-2008 levels and not getting anywhere near back to where they once were. Only the United States has seen respectable recovery, but it's still well below historical averages. The lack of major profitable investment opportunities is going to be even more keenly felt this time around now that China is on the ropes. At least post-2008 had the seemingly endless Chinese Miracle to prop up investor hopes. Where are they going to put their money now? Won't somebody think of the investors????  And besides, there are still plenty of developing economies. People keep making noise about India, although I'm not sure when something will actually happen there

|

|

|

|

Vermain posted:Where are they going to put their money now? The US is the only game in town at the moment. Venomous posted:So will this gently caress over Hillary in the general? Nope.

|

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. That system exists. It's called a barrel. Joking aside, I still don't see it as a great idea if only very simply because existing distribution networks have zero incentive to let you buy cheap gas and then hold it in some sort of virtual reserve rather than just selling you expensive gas later.

|

|

|

|

icantfindaname posted:And besides, there are still plenty of developing economies. People keep making noise about India, although I'm not sure when something will actually happen there Developing economies have been among those faring most poorly since 2008 and will be disproportionately affected by a Chinese downturn.

|

|

|

|

ReidRansom posted:That system exists. It's called a barrel. First one to do it probably makes a fuckton of money right upfront though. I imagine.

|

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. The problem that you have is that no one is going to be interested in the idea of selling you gasoline redeemable "whenever" because their value is constantly decreasing due to storage and transport costs. The only entities that buy the way that you're describing are big air carrier and shipping firms (e.g. Delta Airlines).

|

|

|

|

Zeroisanumber posted:The US is the only game in town at the moment. ...and that's why you're seeing a lot of capital flee emerging markets and go to US, and skyrocketing US dollar. In addition, it almost feels like people are anticipating an impending shitstorm and moving all their capital to good ole USD just to be sure.

|

|

|

|

So, weve been waiting over a year now for super high decay rate shale wells to start rolling off. Its happening, but at a much slower pace than was initially predicted. Ultimately we need to shave off another 700k bbl/day, give or take, for things to start equalizing. Global demand increases have been poo poo thanks to China and the global economy in general (this is actually good if you care about like, the environment). One thing that always struck me as funny is that a 1-2% oversupply in the market has cratered prices over 70%, talk about sensitive! The thing that worries me is that swings both ways, and a 2% under supply...ugh... So you have a lot of the majors taking 20-40% CAPEX reductions (no new wells), a US rig count somewhere in the 'lol' range, massive industry layoffs and hostile acquisitions, all with no end in sight. Basically, we are demolishing the infrastructure needed to equalize production/demand and risk heading directly into under supplied. One interesting driver in this has been smaller, high cost, producers that exploded in the 'shale revolution' investment boom. Even though prices are poo poo and they lose money on every barrel, they have to keep producing just to service debt - reducing prices further. Eventually they will die, they're effectively dead already, and Im sure all that wonderful debt has been sliced, diced, and CDO'd into all sorts of great financial products. Who knows what, if anything, that will lead to but at the minimum a lot of banks are going to be sitting on oil and gas assets going "what the gently caress am I supposed to do with this exactly?" Not only could cutting too hard, too fast, result in prices going through the roof once production craters past equilibrium (inventory has to roll off too which adds a cushion. My confidence in the industry as a whole to act accordingly is about 0) - Saudi Arabia, Iran, and others stand to pick up a lot of market share if they time it right. I know no one really like fracing but if the choice is between that and further funding terroristic and inhumane dictatorships I'd have to go with the former.

|

|

|

|

Acelerion posted:One interesting driver in this has been smaller, high cost, producers that exploded in the 'shale revolution' investment boom. Even though prices are poo poo and they lose money on every barrel, they have to keep producing just to service debt - reducing prices further. Eventually they will die, they're effectively dead already, and Im sure all that wonderful debt has been sliced, diced, and CDO'd into all sorts of great financial products. Who knows what, if anything, that will lead to but at the minimum a lot of banks are going to be sitting on oil and gas assets going "what the gently caress am I supposed to do with this exactly?" Yeah most of those shale producers are now unable to open new wells because they are 1:1 profit to Debt payment. They are called zombie companies because of this issue. Once their old wells dry up they will die, unless oil skyrockets to $200 a barrel.

|

|

|

|

Acelerion posted:Who knows what, if anything, that will lead to but at the minimum a lot of banks are going to be sitting on oil and gas assets going "what the gently caress am I supposed to do with this exactly?" Cap the well and wait. Half of loving Williston, ND is in standby mode waiting for prices to get better.

|

|

|

|

Not always possible. Everything has a cost including shutting a well in and ensuring it stays that way safely. Companies, smaller ones particularly, look for investment for projects, and that has to be paid back. Often it means they have no choice but to produce and sell. Prices are hitting the point where shutting in is economical in some cases though. edit: a lot of what you may see as 'on hold' is drilled but uncompleted. Companies making use of cheap rig rates to drill the hole but not putting in the hardware it takes (and perforating/fracing) to bring the well on line. Acelerion fucked around with this message at 23:54 on Jan 12, 2016 |

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. One way to hedge future price increases would be to buy oil company stock. A (significantly) more advanced method would be options/futures contracts on the commodity itself.

|

|

|

|

I was also under the impression that a lot of the leases in TX at least were written in a way that if they weren't being actively worked they would eventually revert back to the owner of the land. A lot of people got burned by the last Texas oil boom/bust where the leased land sat idle because the company it was leased to didn't want to do anything until prices recovered.

|

|

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. Short of playing options/futures no one is going to hold gasoline for you. Also, you have about 6-9 months for prices to go back up, because your gasoline is going to destabilize.

|

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons. JohnGalt posted:Short of playing options/futures no one is going to hold gasoline for you. People will do it just not for free, there's a place here in MN that does it but I'm not sure of all of the details. I'm sure they have some sort of fees or something involved to make it worthwhile for them.

|

|

|

|

The other thing, besides fracing that's driven down the price is climate change. The realities of climate change means that there becomes a point in the out-years where the future value of oil reserves approaches 0. That's why you see aramco thinking about selling shares and the Saudis pumping like no tomorrow. Because they recognize that there will only be a few decades left to pump their oil before it becomes worthless. Better to sell barrels at $30 or $20 than not at all.

|

|

|

|

Trabisnikof posted:The other thing, besides fracing that's driven down the price is climate change. The realities of climate change means that there becomes a point in the out-years where the future value of oil reserves approaches 0. That's why you see aramco thinking about selling shares and the Saudis pumping like no tomorrow. Because they recognize that there will only be a few decades left to pump their oil before it becomes worthless. Better to sell barrels at $30 or $20 than not at all. We use Oil to make Plastic so as long as we need Plastic Crap we will need Oil.

|

|

|

|

reignofevil posted:We use Oil to make Plastic so as long as we need Plastic Crap we will need Oil. bioplastics is a huge deal that will keep growing and industrial usage of oil accounts for 1/4 of world demand. So sure, they'll be some people out there but not enough to hang your Kingdom's economy on much longer.

|

|

|

|

I support these economic turn of events.

|

|

|

|

SA is squeezing out economic competitors--giving them a good sweating like Carnegie said. It also serves their regional interests because it cuts into Iran's coming post-embargo and Isis' current oil profits.

|

|

|

|

JeffersonClay posted:SA is squeezing out economic competitors--giving them a good sweating like Carnegie said. It also serves their regional interests because it cuts into Iran's coming post-embargo and Isis' current oil profits. Sustained high oil prices also cause investment in alternatives, something SA would like to avoid for as long as possible.

|

|

|

|

Wow a lot of people seem to think this is SA's doing when really they don't have a choice at all in the matter. Cutting production would accomplish nothing for them, it's not the 80s anymore. They need cash and they can pump profitably at just about any price, pump and pray is about the only choice they have right now.Venomous posted:So will this gently caress over Hillary in the general? Not as much as Trump will schlong her. Trabisnikof posted:The other thing, besides fracing that's driven down the price is climate change. The realities of climate change means that there becomes a point in the out-years where the future value of oil reserves approaches 0. That's why you see aramco thinking about selling shares and the Saudis pumping like no tomorrow. Because they recognize that there will only be a few decades left to pump their oil before it becomes worthless. Better to sell barrels at $30 or $20 than not at all. Where in the hell do you get this from? There's no way in hell CC drives oil to 0 that doesn't make any sense whatsoever. Gas is an incredibly useful resource and so long as someone can profitably extract it there will be someone who wants to burn it. tsa fucked around with this message at 03:40 on Jan 13, 2016 |

|

|

|

Shifty Pony posted:I was also under the impression that a lot of the leases in TX at least were written in a way that if they weren't being actively worked they would eventually revert back to the owner of the land. A lot of people got burned by the last Texas oil boom/bust where the leased land sat idle because the company it was leased to didn't want to do anything until prices recovered. I'm not super sure on leases, but mineral rights in Texas more generally are pretty fucky. And they trump surface rights. Doesn't matter how much surface you own, if someone else has the minerals they can build wells and roads and all other manner of poo poo all over your land with no compensation even if they gently caress poo poo up or destroy your property value.

|

|

|

|

tsa posted:Wow a lot of people seem to think this is SA's doing when really they don't have a choice at all in the matter. Cutting production would accomplish nothing for them, it's not the 80s anymore. They need cash and they can pump profitably at just about any price, pump and pray is about the only choice they have right now.

|

|

|

|

It's a drastic departure from past policy and is specifically to drive higher cost producers out of business and maintain market share. They could cut production by 5% and double what they sell a barrel of oil for. Incidentally it may put other opec members out of business and is creating serious tension. I don't have a good frame for how different it may be from other busts but p much everyone but sa is pushing for cuts. Russia has even hinted they would go along with it.

|

|

|

|

tsa posted:Where in the hell do you get this from? There's no way in hell CC drives oil to 0 that doesn't make any sense whatsoever. Gas is an incredibly useful resource and so long as someone can profitably extract it there will be someone who wants to burn it. 1. Oil isn't Gas, I said oil. 2. Decarbonization is happening and will eventually smoother demand. SA will leave oil in the ground. 3. Like I said, there will be oil refiners but it won't be a market to support a kingdom with.

|

|

|

|

Oil may be cheap, but up here in washington state, there are gas stations still trying to sell at $2.50 per gallon. This while I can go down the block and find another station selling for 40-50 cents less.

|

|

|

|

Nevvy Z posted:I had this idea recently. Someone should setup a system by which I can buy a couple hundred bucks of gas redeemable whenever. Basically small scale private speculation by the x number of gallons.

|

|

|

|

Where's my home delivery?

|

|

|

|

MaxxBot posted:People will do it just not for free, there's a place here in MN that does it but I'm not sure of all of the details. I'm sure they have some sort of fees or something involved to make it worthwhile for them. That Time I Tried to Buy an Actual Barrel of Crude Oil posted:"Don't buy a barrel of oil," the broker repeated after I had outlined my reasoning, declining the offer of my business with grim finality. The gas trader nodded sagely. Lightning flashed behind him. A waitress appeared, suddenly and bearing many wine lists, at our table.

|

|

|

|

Chevron (CVX) is down 1% today and oil dropped below $30/bbl again before settling at $30.22. Gonna wait until it falls below $30 and stays there at close and then buy, buy, buy! Also, the Russians have to revise their budget because they forecast at $50/bbl so lol.

|

|

|

|

|

| # ? Apr 26, 2024 17:13 |

|

As someone who lives in Oklahoma and suffers through daily earthquakes I would like to thank Saudi Arabia for loving with frackers. Although I feel like if Saudi Arabia doesn't drive them into bankruptcy, the class action lawsuits certainly will. They're causing billions of dollars worth of damage to buildings. Rand alPaul fucked around with this message at 08:29 on Jan 14, 2016 |

|

|