|

raminasi posted:in whose interest is nationalizing disruptr, exactly? nobody in the world wants the government to own that. (do you?) and that's not even getting to i would love most companies in the economy to be state owned (if not state run) but even leaving that aside, the government should still get that equity and sell it off if they don't want to keep it so that the investors in these companies don't get made whole for nothing

|

|

|

|

|

| # ? Apr 28, 2024 12:46 |

|

EricBauman posted:since the banks received the face value of the bonds that they were going to get anyway in eight years, i wouldn't consider this a bailout. if i need an 8 year advance on payments, nobody gives a poo poo. thatís why people are calling it a bailout. this isnít hard to understand

|

|

|

|

infernal machines posted:wait... leo laporte still has a job? not only does he have a job but he's a job creator union buster now too!

|

|

|

|

infernal machines posted:wait... leo laporte still has a job? honestly figured he died lol

|

|

|

|

Jonny 290 posted:"yes, i know how people get rich, but i'm not doing it myself, instead i'll write lovely papers about it for $40k a year" - statements uttered by the deranged the phrase is "i don't have the stomach for this" because days like today are how you get ulcers

|

|

|

|

mila kunis posted:i would love most companies in the economy to be state owned (if not state run) but even leaving that aside, the government should still get that equity and sell it off if they don't want to keep it so that the investors in these companies don't get made whole for nothing i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash?

|

|

|

|

raminasi posted:i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash? literally yes, but only if you're somebody that they've marked as an Enemy of the State (i.e. a capitalist) they are a very naive and childish communist

|

|

|

|

raminasi posted:i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash? bank investors and bank depositors are two different groups

|

|

|

|

raminasi posted:i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash? ???

|

|

|

|

Shame Boy posted:bank investors and bank depositors are two different groups this

|

|

|

|

raminasi posted:i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash? That only happens if OP thinks you're bad. I guess if you're deemed good something else happens but I'm not sure that part of the master plan has been revealed yet.

|

|

|

|

raminasi posted:i genuinely don't understand your ideal model of depository banking. if i deposit money in a bank, and that bank fails, the government takes some of my other stuff and sells it to someone else, keeping the cash? Internaut! posted:can I get that same relief for my LTD portfolio which has taken a similar beating over the past year? Internet Janitor posted:in summary, this isn't grandma and grandpa's savings accounts right? if these companies are getting a penny above what was FDIC insured they should be giving up something in return because i, regular person, definitely loving wouldn't be getting poo poo. if the intent here and the reason this is being done is to save the jobs of valets, cooks and the starving artists and crafters owed by etsy, then i think they'll be okay with the companies giving up equity in return! if this isn't happening, then i'd be forced to conclude that the rhetoric about jobs is just pure dishonesty and the intent here is preferential state treatment for the assets of rich investors.

|

|

|

|

Cold on a Cob posted:not only does he have a job but he's a job creator union buster now too! Beeftweeter posted:honestly figured he died lol i thought he had finally been cancelled or whatever after the fourth or fifth time his dick appeared during a stream

|

|

|

|

mila kunis posted:this isn't grandma and grandpa's savings accounts right? if these companies are getting a penny above what was FDIC insured they should be giving up something in return because i, regular person, definitely loving wouldn't be getting poo poo. individual depositors are being made whole as well. unless you're going to say those don't count because by definition they have over $250k in cash

|

|

|

|

PIZZA.BAT posted:individual depositors are being made whole as well. unless you're going to say those don't count because by definition they have over $250k in cash i think that's literally what they're saying, yes

|

|

|

|

PIZZA.BAT posted:individual depositors are being made whole as well. unless you're going to say those don't count because by definition they have over $250k in cash individual depositors do not by definition have over $250k. they may or may not. the point is that FDIC insurance is nominally up to that amount

|

|

|

|

Shame Boy posted:i think that's literally what they're saying, yes and we can agree that this is insane, right? making a bunch of businesses bankrupt because a bank failed is bad, and saying "but have you considered that the investors of those businesses are rich?" doesn't magic away all the other consequences of a decision like that? and "it's fine those businesses should just be nationalised" is the bonkers cherry on top?

|

|

|

|

Beeftweeter posted:individual depositors do not by definition have over $250k. they may or may not. the point is that FDIC insurance is nominally up to that amount

|

|

|

|

Chalks posted:and we can agree that this is insane, right? making a bunch of businesses bankrupt because a bank failed is bad, and saying "but have you considered that the investors of those businesses are rich?" doesn't magic away all the other consequences of a decision like that? everyone except the person earnestly stating those opinions is probably in agreement, yes.

|

|

|

|

Chalks posted:and we can agree that this is insane, right? making a bunch of businesses bankrupt because a bank failed is bad, and saying "but have you considered that the investors of those businesses are rich?" doesn't magic away all the other consequences of a decision like that? if those businesses should absolutely be saved by a bailout then they should give up equity in return, yes.

|

|

|

|

the intent here is preferential state treatment for the assets of rich investors.

|

|

|

|

mila kunis posted:if those businesses should absolutely be saved by a bailout then they should give up equity in return, yes. yeah this is what i mean by not understanding what you want in a depository banking system. they're fundamentally built on trust, and that can't exist if whenever your bank fails the government gets your poo poo.

|

|

|

|

mystes posted:I think they meant "unless you're going to say that individual depositors who are being bailed out don't count as regular people because by definition to be in a position where they're affected by the bailout they must have more than $250k" or something like that i mean, an individual depositor is an individual depositor. it doesn't matter if that's a person or a corporation (  corporations are people, friend) corporations are people, friend)normally if this had happened they'd be fine if they had kept deposits under that amount or diversified where they are. the fdic just bent the gently caress out of the rules and as a result shareholders in banks think they have to dump shares, because if they fail, the investors are screwed but the depositors are fine, now it's very funny but also incredibly frustrating

|

|

|

|

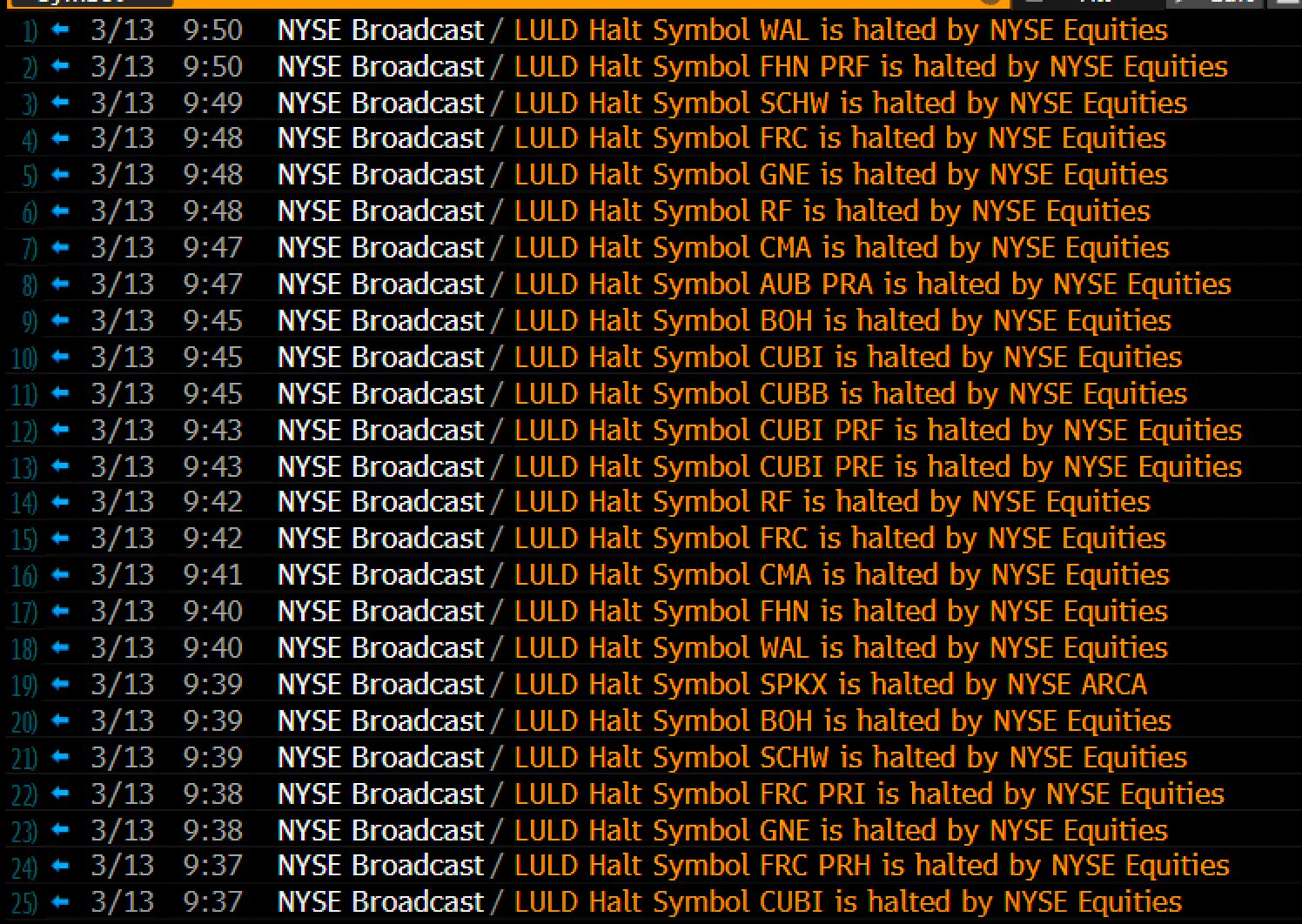

TDepressionEarl posted:the intent here is preferential state treatment for the assets of rich investors. no. the investors specifically are getting hosed here. that's why there's been like 70 trading halts today

|

|

|

|

absolutely running around like chicken little, i was. no reason to be afraid at all! watch one of the big 4 banks enter the pink sheets by end of april lol the ablative armor is ablating at least

|

|

|

|

bob dobbs is dead posted:absolutely running around like chicken little, i was. no reason to be afraid at all! treasury/fed/fdic letting investors get hosed was the right idea, but this was completely predictable

|

|

|

|

it gets a bit tricky to have any sensible argument about what the entities involved here should do or have done to them if the *only* driving motivation one has is that the entities should not exist. it is an entirely fair position to hold, that the banking system, vc funded startups, and government functions captured by the financial market should all be killed off, but in the realm of things that were going to happen over the weekend those were probably not ever in play.

|

|

|

|

raminasi posted:yeah this is what i mean by not understanding what you want in a depository banking system. they're fundamentally built on trust, and that can't exist if whenever your bank fails the government gets your poo poo. i believe what happens in a depository banking system is that you get the money back that you held in an insured account, for the value that that insurance covers. if you get special government favours that get you everything back for nothing, when regular people otherwise would not, then i think its reasonable for people to state that it's a rigged and corrupt system doing corrupt things, espescially in the context of public services and the commons being privatized and wealth being funneled upwards for the last 4 decades.

|

|

|

|

TDepressionEarl posted:the intent here is preferential state treatment for the assets of rich investors. preferential over the small depositors who were already 100% safe?

|

|

|

|

i think mila kunis is describing a state run bank, i.e. basically let the government hold on to deposits, extend loans if needed, guarantee withdrawals in any case, etc. this is effectively what they did over the weekend without actually cutting out the middleman. they're advocating for the elimination of private banking, not depository banking i suspect most of you know this. c'mon

|

|

|

|

regular peeps would get everything back, normal limit is 250k...

|

|

|

|

mila kunis posted:i believe what happens in a depository banking system is that you get the money back that you held in an insured account, for the value that that insurance covers. you keep saying "for nothing" like that's not the way that depository banking is expected and relied upon to work. when i deposit money in a bank, i expect to be able to get it back "for nothing," because it's a bank. the $250k insurance limit is just kind of an arbitrary one, it's not magic or special. would you support raising the insurance limit to ten billion dollars? because that would cause the same outcome for depositors.

|

|

|

|

bob dobbs is dead posted:regular peeps would get everything back, normal limit is 250k... mila kunis posted:i believe what happens in a depository banking system is that you get the money back that you held in an insured account, for the value that that insurance covers. yep.

|

|

|

|

Beeftweeter posted:i think mila kunis is describing a state run bank, i.e. basically let the government hold on to deposits, extend loans if needed, guarantee withdrawals in any case, etc. they are describing an earnest belief that if your fart app startup had its payroll in a bank that failed, the government should take your fart app startup (or at least part of it) in exchange for returning your money to you.

|

|

|

|

raminasi posted:you keep saying "for nothing" like that's not the way that depository banking is expected and relied upon to work. you also need to get the chicks for free if you get money for nothing, everyone knows this

|

|

|

|

Beeftweeter posted:no. the investors specifically are getting hosed here. that's why there's been like 70 trading halts today the investors are being given some extra time to set their fantasy football lineups. the investors will get their credit. Chalks posted:preferential over the small depositors who were already 100% safe? the large uninsured depositors are also 100% safe

|

|

|

|

one red day a year oh no the sorry investors. rich investors have the inside track. the svb ceo pulled $3.5m in stock before they became worthless.

|

|

|

|

Shame Boy posted:you also need to get the chicks for free if you get money for nothing, everyone knows this

|

|

|

|

share prices dropping is not the same as a bank run though. It's perfectly possible to stay solvent while your share price drops. e: but shareholders are going "oh gently caress we would lose our money if we were, quick, sell!" But ofc someone else is buying so there are people out there going "I can buy these shares at 25% discount and wait for return to normal because bank X isn't going to default now that the fed is supplying (effectively) unlimited liquidity as a backstop to having to sell off bonds to support deposits

|

|

|

|

|

| # ? Apr 28, 2024 12:46 |

|

Powerful Two-Hander posted:share prices dropping is not the same as a bank run though. It's perfectly possible to stay solvent while your share price drops. investors also can make money when the shares drop off short selling

|

|

|