|

US recessions are officially declared by the National Bureau of Economic Research, some time after they have begun. https://www.nber.org/research/business-cycle-dating https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions As Big Tech finally started layoffs and there's still great ongoing debate about Federal Reserve actions and 'soft landing' vs recession, let's take BFC's temperature. How's it going out there? Recession or no recession in 2023?

|

|

|

|

|

| # ? Apr 29, 2024 14:09 |

|

No recession. High price stick around, but supply chains continue to recover driving corporate profits and overall economic productivity. Also, I’m still using the two consecutive quarters of GDP decline definition. Cool thread idea btw Dik Hz fucked around with this message at 16:39 on Jan 31, 2023 |

|

|

|

No US recession in 2023; the news in the UK was very fond of posting this chart around yesterday and going from +4% from pre-COVID to negative in the space of a year means COVID level disruption (with early 2022 being the tail end of COVID restrictions for YoY comparisons) - Inflationary pressure from last year will also start to subside as the year-on-year figures start taking the ramp up in prices as baseline and no matter what the Fed does on interest rates the wealthy and business are not going to stop investment just because they can now get 4% sitting in cash (7% in I-Bonds however...)

|

|

|

|

Inflation driving GDP nominally higher while being in real decline seems very 2023. I know there are normalized GDP measures, but I’m not sold on them in the same way I’m not sold on common wonk measures of inflation*. *which exclude food and energy while notionally including housing but it’s based on “owners equivalent rent”. Congrats you have an inflation metric which doesn’t measure inflation. I think there are many recession metrics out there which do not measure recessions in a similar manner. I think agreeing on a common, objective, measurable definition is step 1. Step 2 is bullshitting over whether that definition will be met in 2023.

|

|

|

|

DNK posted:Inflation driving GDP nominally higher while being in real decline seems very 2023. I know there are normalized GDP measures, but I’m not sold on them in the same way I’m not sold on common wonk measures of inflation*. In effect, wouldn't that be more like a form of stagflation?

|

|

|

|

https://i.imgur.com/4e84MI3.mp4

|

|

|

|

My vote is No, because that would be bad for Number. Also, because greed can grow GDP while still loving over normal people.

|

|

|

|

Why are we buying into this framing that a technical recession matters? It's trying to capture the entire US economy, around 23 trillion dollars, in a single number. Except, if Amazon did gangbusters and Bezos wealth doubled, GDP could increase 100% and it wouldn't really matter. The only reason GDP still gets talked about is because we talk about it, it's a very lovely measure that misses many things, and is generally more misleading than useful as a measure of the impact of current economic trends on actual human beings.

|

|

|

|

pseudanonymous posted:Why are we buying into this framing that a technical recession matters? nobody here framed it that way. this is a water cooler bullshit chat thread and poll, try and have fun

|

|

|

|

pseudanonymous posted:Why are we buying into this framing that a technical recession matters? Yeah we know it's pointless. We're just bored.

|

|

|

|

I look forward to the end of the year so I can reflect back on how completely wrong I was.

|

|

|

|

Dik Hz posted:I look forward to the end of the year so I can reflect back on how completely wrong I was. I was right last year, there was no recession in 2022. But for some reason I still lost a lot of money, damnit. Looking forward to the same thing happening this year!

|

|

|

|

What is the bear case here? A few banks lightly warning a recession later in the year is possible? Someone post good bear takes imo

|

|

|

|

err posted:What is the bear case here? A few banks lightly warning a recession later in the year is possible? the most common bear thesis is that the fed will overshoot in its fighting of inflation, damaging the rest of the economy. basically what volcker did to crush inflation at the start of the '80s

|

|

|

|

|

|

|

|

pmchem posted:the most common bear thesis is that the fed will overshoot in its fighting of inflation, damaging the rest of the economy. basically what volcker did to crush inflation at the start of the '80s Is there any data showing it could be the case here or is it still too early to get those indicators? I feel like the recession fear rhetoric has faded the past few months and especially the last few weeks.

|

|

|

|

Baddog posted:I was right last year, there was no recession in 2022. But for some reason I still lost a lot of money, damnit. What, you didn't enjoy 15-20% declines in all your retirement accounts while everyone posted record profits?

|

|

|

|

err posted:Is there any data showing it could be the case here or is it still too early to get those indicators? there's leading data here and there, but nobody really knows how things will pan out. I thought the poll would be interesting in part *because* recession fear has faded during january. here's one example of indicator data related to employment (shaded areas are recessions): https://twitter.com/FXstreetReports/status/1618567586483937280?s=20 btw not vouching for that indicator being perfect or anything, don't come @ me regarding it

|

|

|

|

pmchem posted:there's leading data here and there, but nobody really knows how things will pan out. I thought the poll would be interesting in part *because* recession fear has faded during january.

|

|

|

|

pmchem posted:there's leading data here and there, but nobody really knows how things will pan out. I thought the poll would be interesting in part *because* recession fear has faded during january. Yeah, it's definitely a good question. Maybe things happen later this year. I can't imagine construction being good this year and that probably has effects elsewhere. I say no recession but a few sectors getting hit this year particularly hard.

|

|

|

|

Dik Hz posted:I wonder how many ways they crunched that data until they stumbled across that version. i know right? imo keep it simple. just look at florida vs nebraska coincident economic indexes. still in no-recession territory  via https://fred.stlouisfed.org/series/FLPHCI (and NEPHCI) pmchem fucked around with this message at 21:31 on Jan 31, 2023 |

|

|

|

|

|

|

|

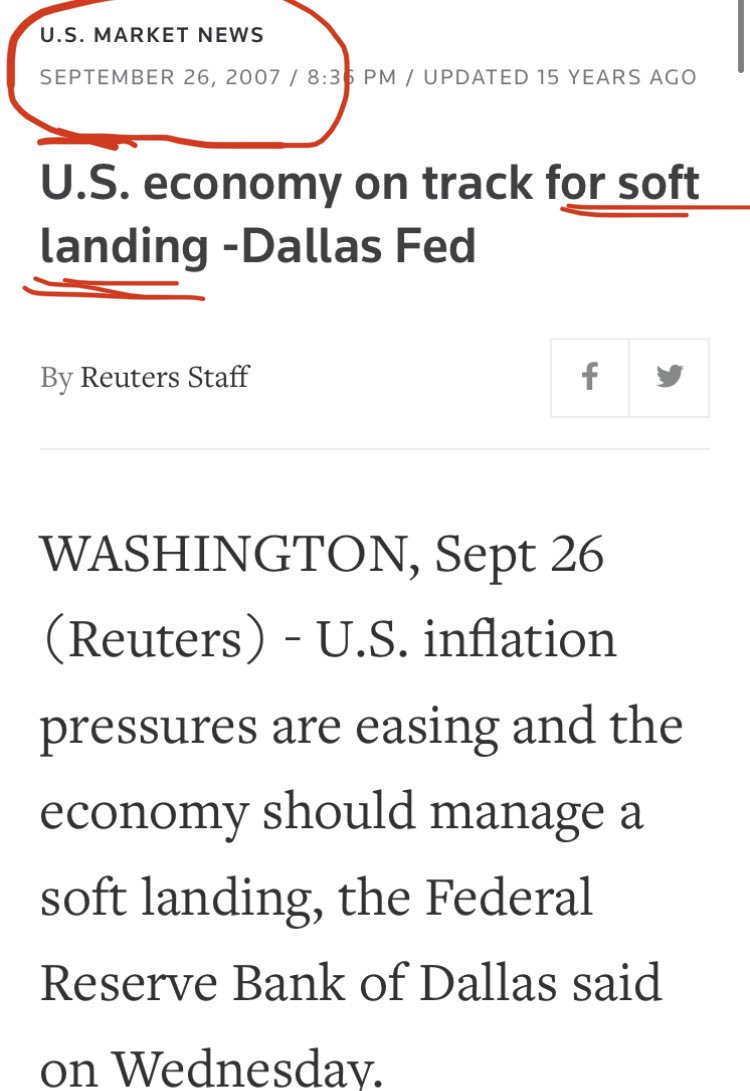

SKULL.GIF posted:Soft landing I suppose executing a perfect dive into the depths of the Marianas Trench would count as soft, right?

|

|

|

|

Commercial real estate is getting kicked so hard in the dick that a few of the big firms are doing some Funny Business with their accounting today so that January's numbers seem less catastrophic than they are How do they REALLY define 'material, non-public information', anyway? I'd love to make a big bet against my own employer, and I'm not in a position where anybody tells me squat, but I don't want to go to jail or pay the small fine or whatever the white collar punishment is these days

|

|

|

|

Everyone leaning on this indicator seems strange to me. We know that it is 99% that in 10 years rates will be lower than they are now, that's why it is priced that way. Not a guarantee that a recession is right around the corner though. But are we dumb for thinking that *this time* the fed will manage the situation correctly? Or will they again not cut rates until it is too late, well after the bread lines are around the block.

|

|

|

|

I think oil prices are down and china is opening up and so overseas shipping costs have dropped way back down to something resembling normal. So I voted No on recession. However, recession can be a self-fulling prophecy. Companies laying people off in anticipation of a recession, tons of unemployment, consumer confidence drops, and wham there you are, recession. So maybe we get one no matter what. There's always a wildcard factor, though. We can't use technical analysis to reliably predict the future because the next black swan doesn't show up on the graphs of the past. A black swan could be positive or negative, mind you, I am really just talking about rare, unpredictable events.

|

|

|

|

Sundae posted:What, you didn't enjoy 15-20% declines in all your retirement accounts while everyone posted record profits? you mean the share price correction that occurred after massive unsustainable increases in p/e?

|

|

|

|

No recession, Chipotle is hiring I can see a scenario where inflation remains elevated (5%+) and nominal GDP is positive but real GDP is negative. If unemployment remains low, I'm not sure that would be considered a recession, though. edit: double negatives are never not confusing drk fucked around with this message at 00:30 on Feb 1, 2023 |

|

|

|

KYOON GRIFFEY JR posted:you mean the share price correction that occurred after massive unsustainable increases in p/e? Ssssh.... when it's my stocks, it's someone's fault!

|

|

|

|

I'm leaning no but I do think it's possible if the Fed decides to go full psycho mode and keep hiking too fast even with inflation cooling. I also think Tech jobs are a bit of an outlier, most of them over hired during the pandemic, many investing into projects that won't see the level of return expected. In some cases they were hiring in the dumbest fashions, like hiring people without knowing where or what they will work on. Basically just hiring them hoping some team would need them because hiring on demand was getting hard. Most of them are still well above their headcounts from before the current explosion started, but they just got too carried away during the biggest hiring frenzy in tech history. I don't think we're quite done with tech layoffs yet, but I think the biggest bombs have probably dropped. Once again with the caveat that the Fed going psycho mode and announcing they are going to keep going big on rate hikes instead of starting to ease back would trash all of this.

|

|

|

|

|

KYOON GRIFFEY JR posted:you mean the share price correction that occurred after massive unsustainable increases in p/e? Well I for one am convinced that will never happen again! Until what, 3 months from now?

|

|

|

|

Lines will fluctuate, quality of life will in general decrease, the official definition for a recession won't be met.

|

|

|

|

unemployment not lower since 1953: https://twitter.com/RandyAFrederick/status/1621505355531550727

|

|

|

|

Doomsday economists in shambles.

|

|

|

LanceHunter posted:Doomsday economists in shambles. Sustained levels of low unemployment historically precedes recessions:

|

|

|

|

|

SKULL.GIF posted:Sustained levels of low unemployment historically precedes recessions: This is another one of those "there is always a calm before the storm" prognostications. How calm is calm, how long can calm go on before we're "due", etc etc etc. Get out the farmer's almanac!

|

|

|

|

SKULL.GIF posted:Sustained levels of low unemployment historically precedes recessions: I think this is a misreading of the data. The fact that unemployment only ever goes up sharply during (and sometimes shortly after) a recession means that the period before the recession will always look like "sustained levels of low unemployment". At best, the statement is a tautology, like saying that a jack-in-the-box springing open is historically preceded by it being closed.

|

|

|

|

Also raw unemployment doesn't tell you everything about people jobs. We've just had two years of high inflation while wages haven't risen to match, so people are working but poorer.

|

|

|

|

Makes me wonder if wage growth was keeping up with inflation. This random chart from google says: sort of? https://www.statista.com/statistics/1351276/wage-growth-vs-inflation-us/ It's still lagging behind by about 1% - 2.5% and the gap is shrinking as inflation starts to finally come down while wage growth remains more steady. I guess that could be worse. I sort of expected to see wage growth stay constant. "You got your 2% raise, what else you want you bastard?"

|

|

|

|

|

| # ? Apr 29, 2024 14:09 |

|

quote:quote:I think this is a misreading of the data. The fact that unemployment only ever goes up sharply during (and sometimes shortly after) a recession means that the period before the recession will always look like "sustained levels of low unemployment". At best, the statement is a tautology, like saying that a jack-in-the-box springing open is historically preceded by it being closed. 2001: Unemployment spikes as SomethingAwful implements $10 forum account fee. This seed of global instability bears fruit with the banning of hentai from ADTRW, popping the dot-com bubble. 2002-2005: Things slowly improve as people realize it's actually better this way. 2006: Uwe Boll punches Lowtax hard enough to cause the economy to slow. Lowtax attributes the following year of general malaise to a lingering concussion until everything comes to a head. December 2006: Groverhaus is posted on SomethingAwful, causing hedge funds everywhere to collectively panic that their mortgage-backed securities might accidentally contain his mortgage. 2007: Nobody can figure out who owns Groverhaus, crashing global lending market. 2008-2019: Lowtax siphons off Patreon funds to secretly fund bank recapitalization plans. Admins circle wagons around global economy and refuse to acknowledge any problems. 2020: SomethingAwful sold to Jeffrey of YOSPOS, causing historical spike in unemployment. 2021: This would be like shooting fish in a barrel, so I'll hold my fire. Oh right, citations (not really, but found this while hunting a few dates):

Sundae fucked around with this message at 00:04 on Feb 4, 2023 |

|

|